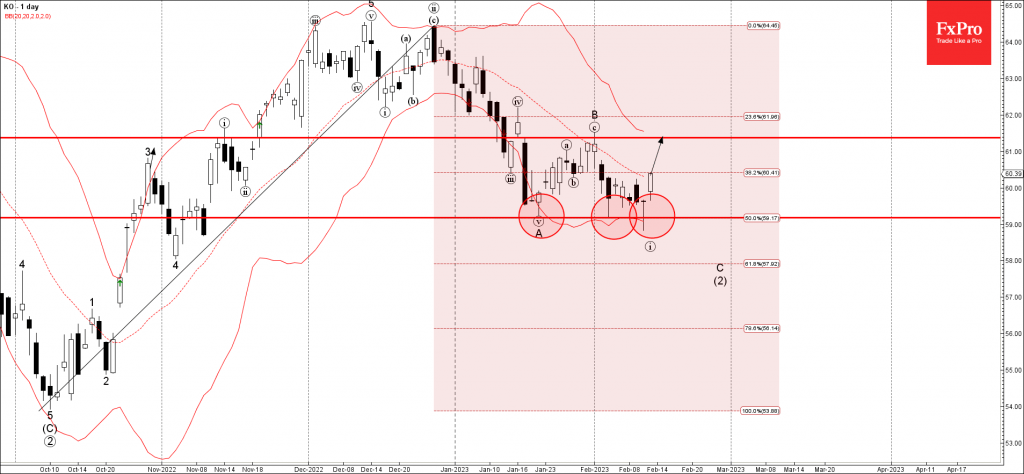

• Coca-Cola reversed from support level 59.20

• Likely to rise to resistance level 61.35

Coca-Cola recently reversed up with the daily Hammer from the key support level 59.20 (which has been reversing the price from the middle of January), standing near the lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse from October.

The upward reversal from the support level 59.20 stopped the previous short-term impulse wave (i), which belongs to the C-wave of the intermediate ABC correction (2) from December.

Coca-Cola can be expected to rise further toward the next resistance level 61.35 (top of the previous wave B).