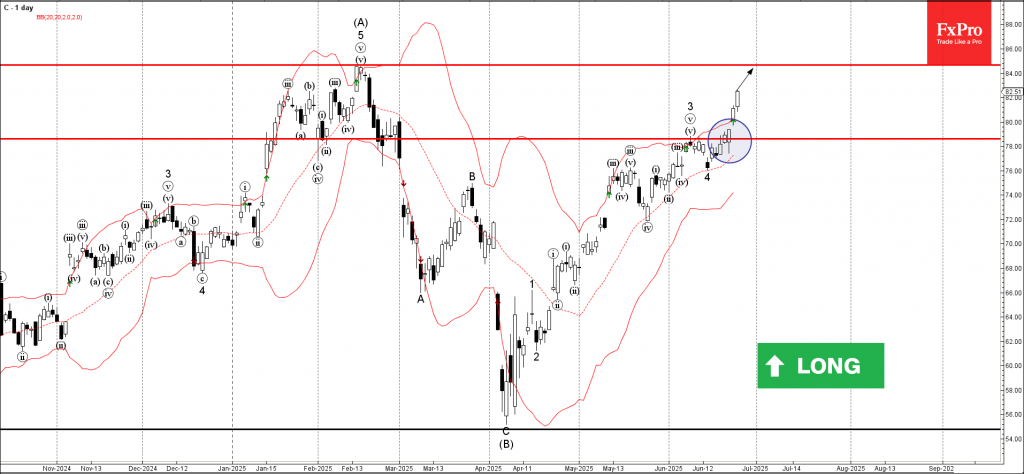

Citigroup: ⬆️ Buy

– Citigroup rose above the resistance level 78.60

– Likely to rise to resistance level 84.65

Citigroup recently rose above the resistance level 78.60, which stopped the previous minor impulse wave 3 at the start of June.

The breakout of the resistance level 78.60 accelerated the active short-term impulse wave 5, which belongs to the sharp intermediate impulse sequence (C) from the start of April.

Citigroup can be expected to rise to the next resistance level 84.65, former multi-month high from February.