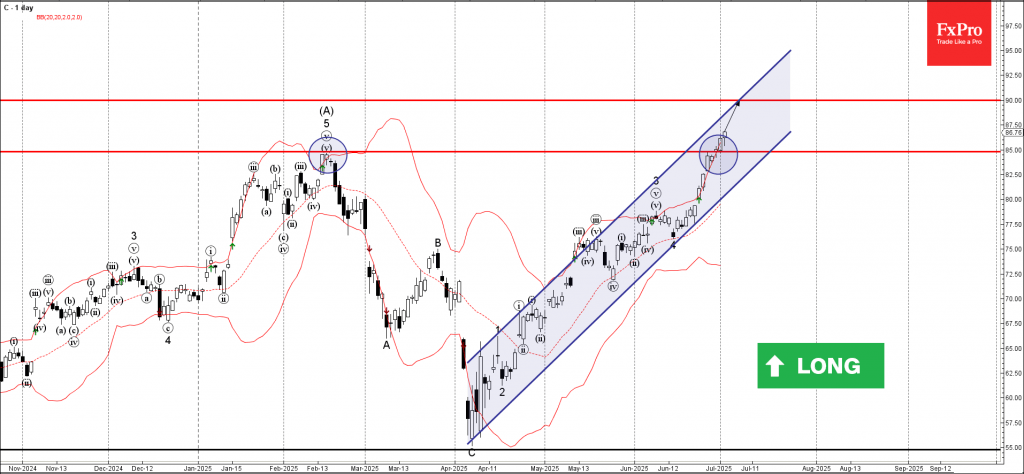

Citigroup: ⬆️ Buy

– Citigroup broke key resistance level 85.00

– Likely to rise to resistance level 90.00

Citigroup recently broke above the key resistance level 85.00 (former multi-month high from February, which stopped the previous wave (A), as can be seen below).

The breakout of the resistance level 85.00 accelerated the active minor impulse wave 5 of the intermediate impulse wave (C) from April.

Citigroup can be expected to rise further to the next resistance level 90.00 (intersecting with the daily up channel from April).