– Citigroup falling inside minor impulse wave 1

– Likely to fall to support level 54.80

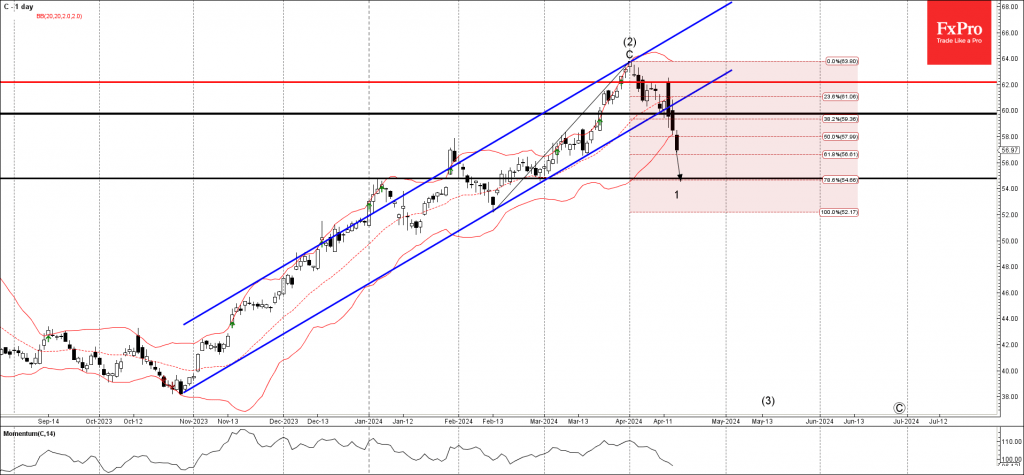

Citigroup falling inside the sharp minor impulse wave 1 of the intermediate impulse wave (3) from the end of March.

The price earlier broke the round support level 60.00 coinciding with the support trendline of the extended up channel from and the 38.2% Fibonacci correction of the upward impulse from February.

Given the strength of the active impulse wave 1, Citigroup can be expected to fall further to the next support level 54.80 (former support from February).