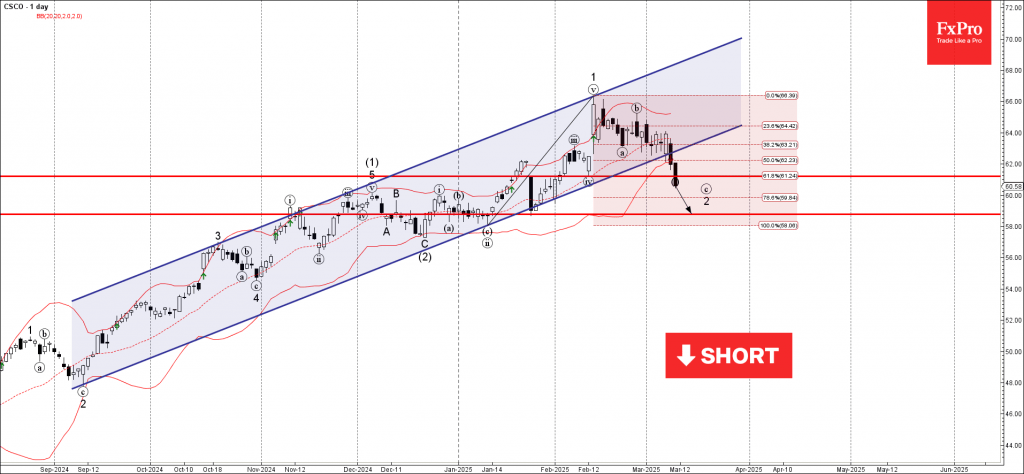

Cisco : ⬇️ Sell

– Cisco broke support area

– Likely to fall to support level 58.80

Cisco recently broke the support area between the key support level 61.20 (which stopped the previous minor correction iv in February), support trendline of the daily up channel from September and the 50% Fibonacci correction of the upward impulse from January.

The breakout of this support area accelerated the active impulse wave c of the ABC correction 2 from the start of last month.

Cisco can be expected to fall to the next support level 58.80 (which reversed the price multiple times in January). Support level 58.80 is also the target price for the completion of wave c.