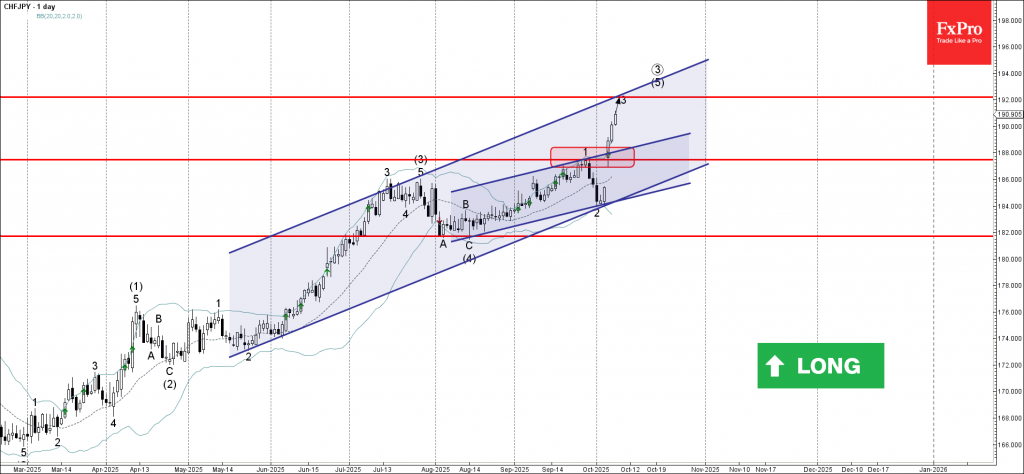

CHFJPY: ⬆️ Buy

– CHFJPY broke key resistance level 187.50

– Likely to rise to resistance level 192.00

CHFJPY currency pair recently broke the key resistance level 187.50 (which stopped the previous impulse wave 1 at the end of September) intersecting with the resistance trendline of the daily up channel from August.

The breakout of the resistance level 187.50 accelerated the active short-term impulse wave 3 of the intermediate impulse wave (5) from the middle of August.

Given the clear daily uptrend and the strongly bearish yen sentiment seen today, CHFJPY currency pair can be expected to rise to the next resistance level 192.00 (target for the completion of the active short-term impulse wave 3).