– GBPNZD reversed from support level 2.0390

– Likely to rise to resistance level 2.0645

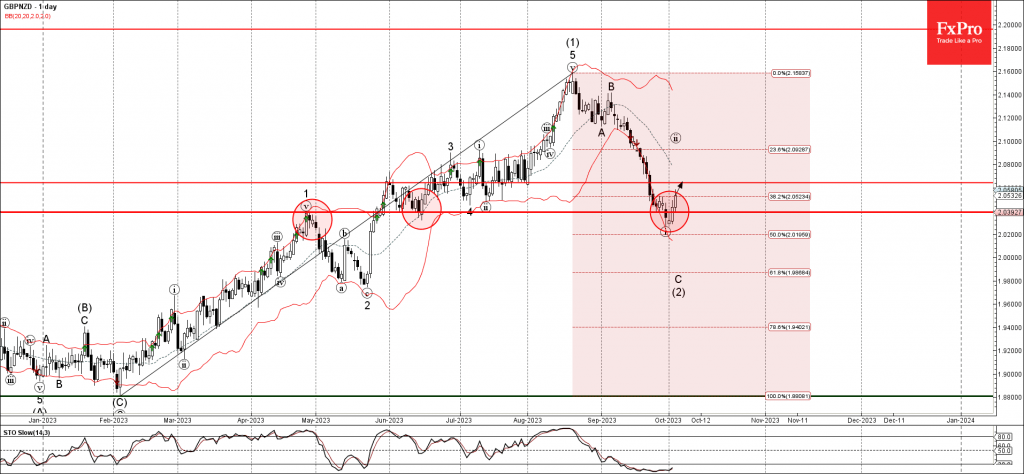

GBPNZD currency pair recently reversed up from the strong support level 2.0390 (former monthly high from April and the monthly low from June), lower daily Bollinger Band and 50% Fibonacci correction of the upward impulse from February.

The upward reversal from the support level 2.0390 stopped the first sharp impulse wave i of the C-wave from the start of September.

Given the clear daily uptrend and the oversold daily Stochastic, GBPNZD can be expected to rise further toward the next resistance level 2.0645.