– CHFJPY reversed from support level 164.30

– Likely to rise to resistance level 166.00

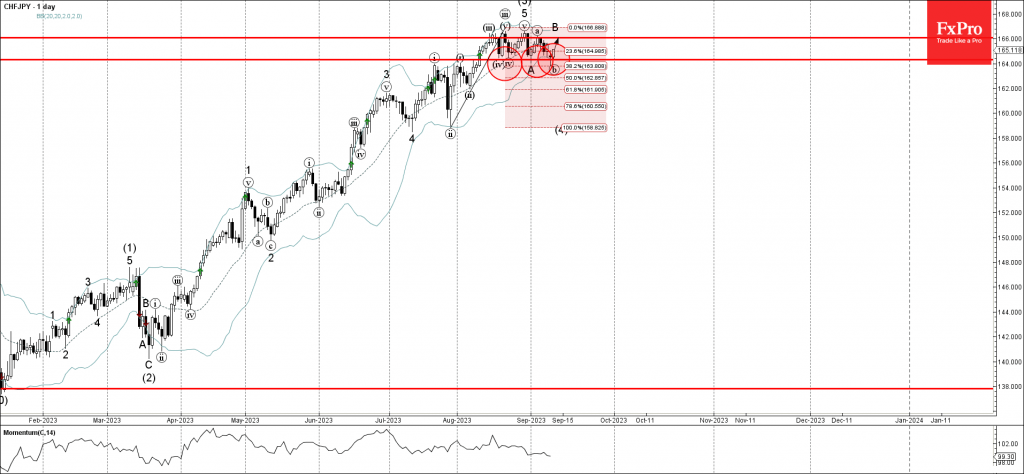

CHFJPY currency pair recently reversed up from the pivotal support level 164.30 (which has been reversing the pair from the middle of August), intersecting with the lower daily Bollinger Band and the 38.2% Fibonacci correction of the upward impulse from July.

The upward reversal from the support level 164.30 stopped the earlier short-term wave b, which belongs to wave B from the end of August.

Given the clear daily uptrend and the continuation of the yen sales, CHFJPY can be expected to rise further toward the next resistance level 166.00 (which has been reversing the price from the middle of August).