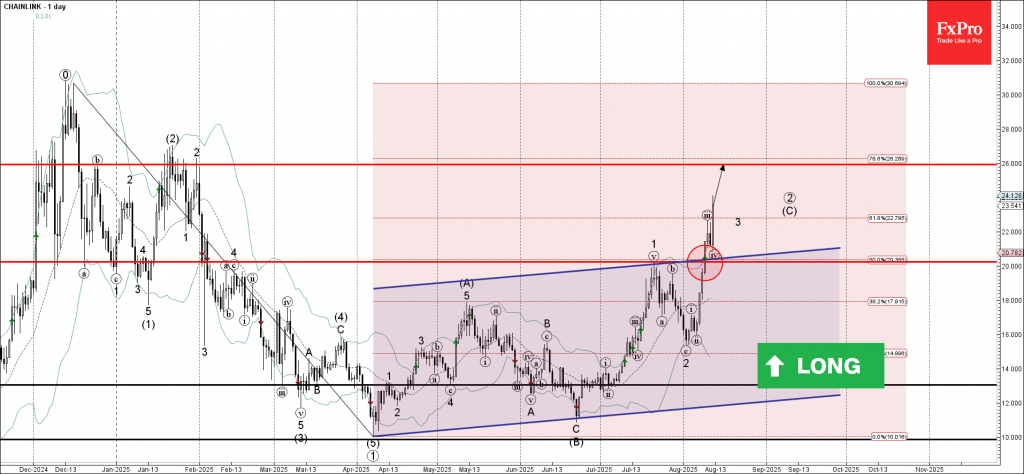

Chainlink: ⬆️ Buy

– Chainlink broke the resistance zone

– Likely to rise to resistance level 26.00

Chainlink cryptocurrency recently broke the resistance zone between the round resistance level 20.00, the resistance trendline of the daily up channel from April and the 50% Fibonacci correction of the downward impulse from December.

The price just reversed up from this price zone (acting as the support zone after it was broken) and continues to rise inside the active impulse wave (3).

Chainlink cryptocurrency can be expected to rise further to the next resistance level 26.00, which is the former strong resistance from January.