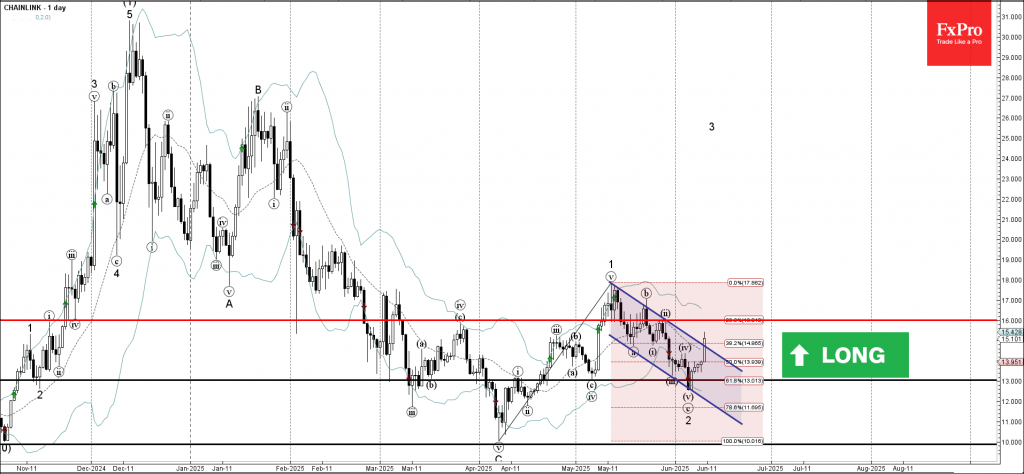

Chainlink: ⬆️ Buy

– Chainlink broke daily down channel

– Likely to rise to resistance level 16.00

Chainlink recently broke the resistance trendline of the daily down channel from the start of May (which encloses the previous minor ABC correction 2).

The breakout of this down channel accelerated the active impulse wave 3, which started earlier from the key support level 13.00.

Chainlink can be expected to rise to the next resistance level 16.00 (top of the minor correction ii from the end of May).