– CADJPY reversed from support area

– Likely to rise to resistance level 108.85

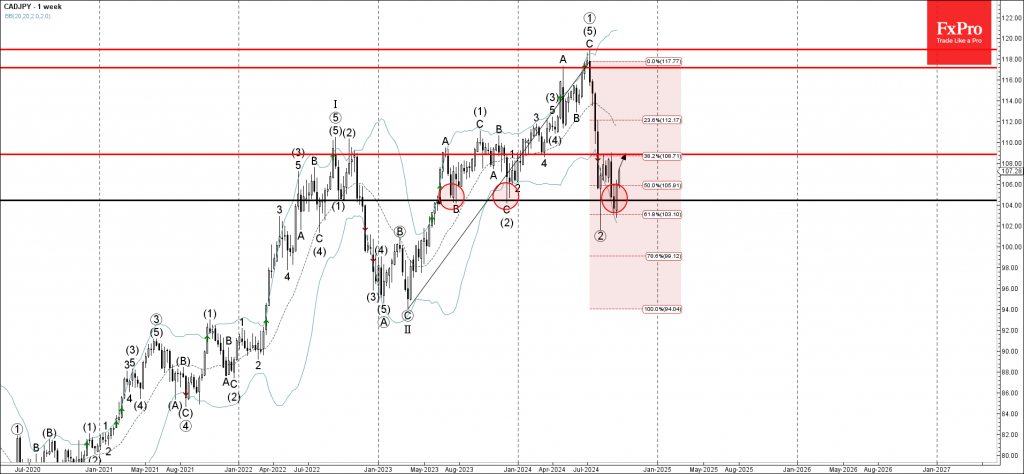

CADJPY currency pair earlier reversed up with the weekly Bullish Engulfing from the support area located between the pivotal resistance level 104.50 (which has been reversing the pair from the middle of August, and the lower weekly Bollinger Band.

This support area was further strengthened by the 61.8% Fibonacci correction of the upward impulse from the start of 2023.

Given the clear weekly uptrend and the continued Canadian dollar bullishness seen across the FX markets, CADJPY currency pair can be expected to rise further to the next resistance level 108.85.