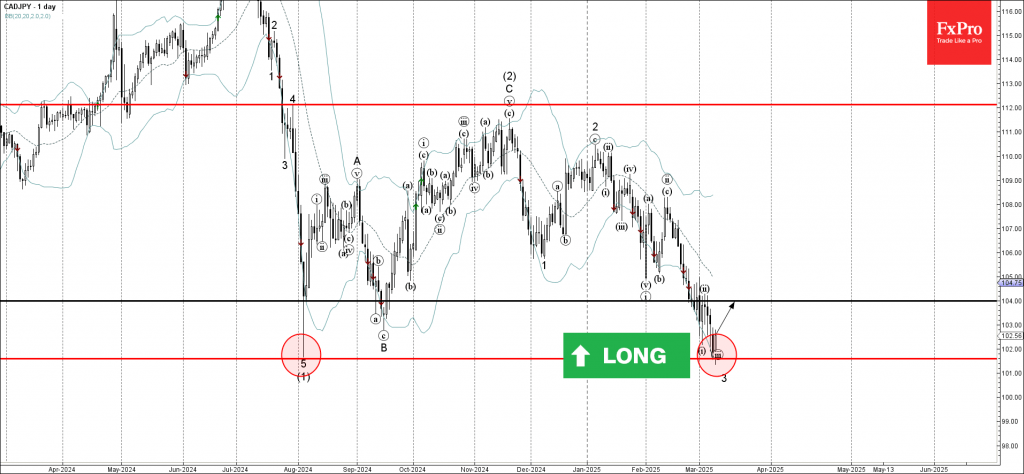

CADJPY: ⬆️ Buy

– CADJPY reversed from the support area

– Likely to rise to the resistance level 104.00

CADJPY currency pair recently reversed up from the support area between the major long-term support level 101.60 (former multi-month support from August) and the lower daily Bollinger Band.

The upward reversal from this support area will likely form the daily Japanese candlesticks reversal pattern Bullish Engulfing.

Given the strength of the support level 101.60, CADJPY currency pair can be expected to rise to the next resistance level 104.00 (former top of wave ii).