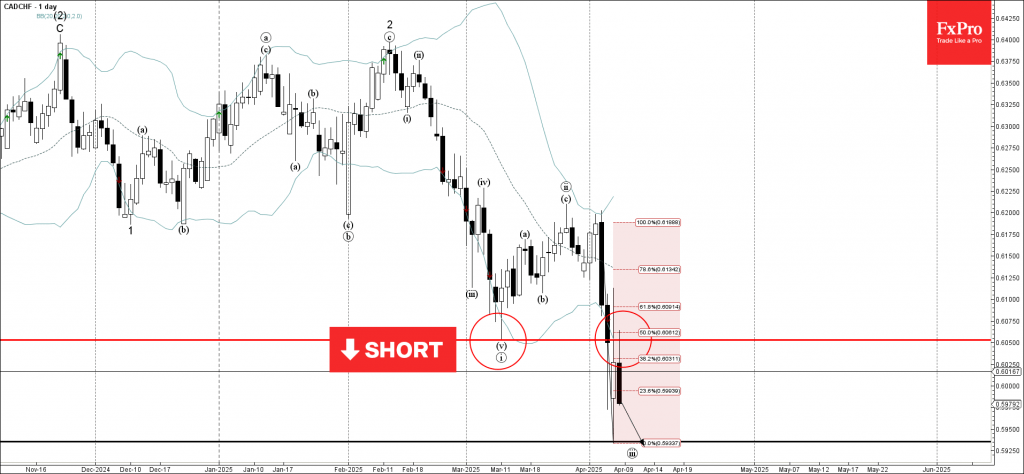

CADCHF: ⬇️ Sell

– CADCHF reversed from pivotal resistance level 0.6050

– Likely to fall to support level 0.5935

CADCHF currency pair recently reversed from the resistance zone between the pivotal resistance level 0.6050 (former monthly low from March) and the 50% Fibonacci correction of the downward impulse from the start of April.

The downward reversal from resistance level 0.6050 continues the active impulse wave iii of the intermediate impulse wave (3) from the end of November.

Given the clear daily downtrend and the strongly bullish Swiss franc sentiment seen today, CADCHF currency pair can be expected to fall to the next support level 0.5935.