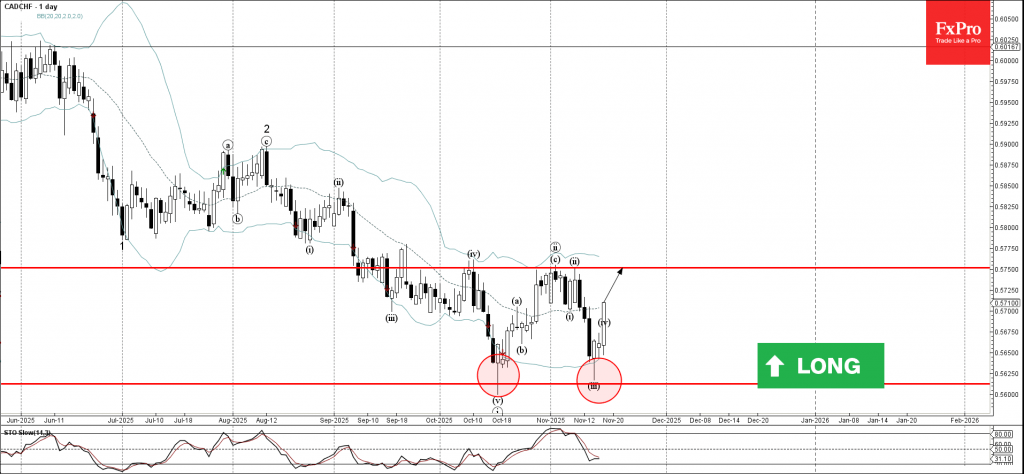

CADCHF: ⬆️ Buy

– CADCHF reversed from key support level 0.5600

– Likely to rise to resistance level 0.5750

CADCHF currency pair recently reversed from key support level 0.5600 (which stopped the previous impulse wave i in the middle of October, as can be seen from the daily CADCHF chart below) standing near the lower daily Bollinger band.

The upward reversal from the support level 0.5600 created the daily Japanese candlesticks reversal pattern Hammer.

Given the strength of the support level 0.5600 and the strongly bearish Swiss franc sentiment seen today, CADCHF can be expected to rise to the next resistance level 0.5750.