The bulls in the US stock markets seem to reverse the single-digit negative sentiment and close the week with major indices rising more than 1%. Increased demand for risky assets put pressure on the dollar. Still, investors and traders should be prepared that the currency market will continue to trend higher, despite some technical bounces and stops.

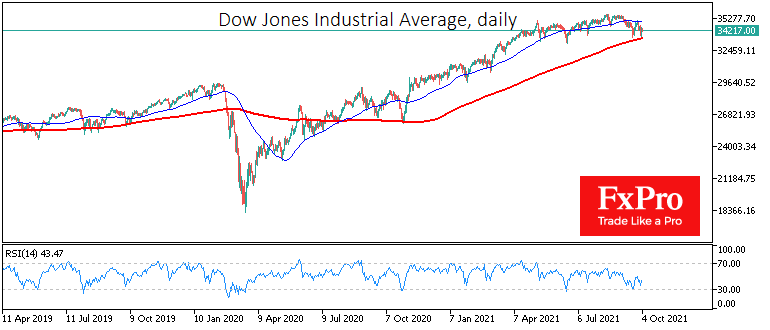

US equity investors are not taking the breaking of the strong bullish trend in equities, stepping up their buying after the Dow Jones index touched its 200-day moving average near 33500 and managing to push the index into the area above 34300 to close the week. This looks like a positive signal that buyers remain committed to a buying strategy on declines.

Last year, the approach of the 200-day average triggered a powerful rally. But there are several differences between the situation a year earlier and now. Technically, back then, the 200-day average was moving horizontally and even had some downward slope, while now it is sharply directed upwards. It is not easy to support the rise in share prices at such a pace.

The fundamentals for growth stocks have also changed: The best quarters in terms of annual earnings growth are clearly behind us. At the same time, the US government is reducing its support for the economy and delaying discussions on new stimulus. The US Federal Reserve said the start of tapering of asset purchases was “warranted” soon, which raises interest rates in debt markets and puts pressure on equities.

The currency market has also seen some shifts. The EURUSD has surrendered a former important support level near 1.1600. At the same time, analysis of speculative positions on the CFTC shows that hedge funds have recently become more active in betting on the fall of the EUR. At the same time, their short positions are far from the pre-pandemic levels, which leaves significant room to increase selling, which should put pressure on the EUR.

The short-term technical picture reflects the potential for a speculative rebound in the EURUSD pair, where the RSI on the daily charts is back above 30. However, the rebound only lasted for a couple of days in June and July in similar conditions, after which pressure on the pair continued.

Having failed under significant support at 1.1600, the EURUSD might encounter little resistance in the weeks ahead until it reaches 1.1400, and the former strong support could become an equally strong resistance. Cancellation of the bearish scenario will only occur after a new consolidation above 1.1675 in the coming days. In that case, we could discuss a false breakdown of support and a return of EURUSD to the previous sideways trend.

The FxPro Analyst Team