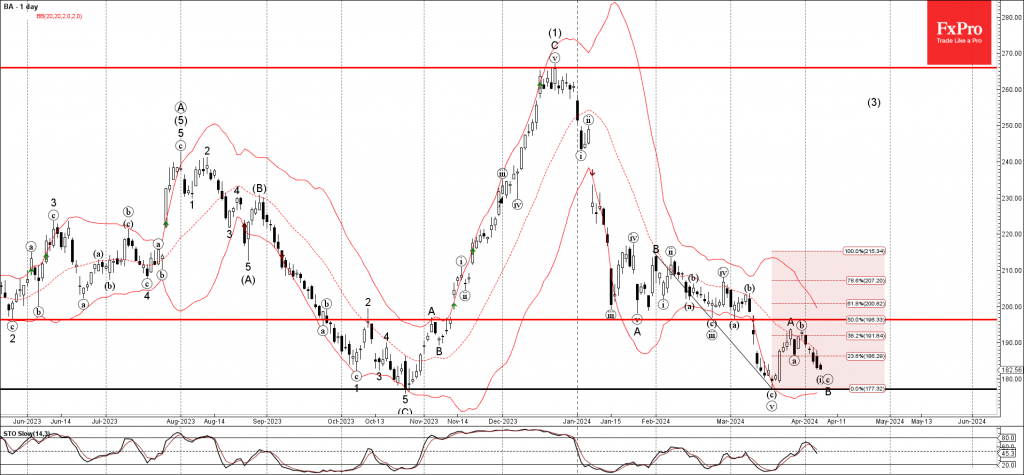

– Boeing reversed from resistance area

– Likely to fall to support level 177.20

Boeing recently reversed down from the resistance area set between the key resistance level 196.34 (former support from February and March) standing near the 50% Fibonacci correction of the downward impulse from January.

The downward reversal from this resistance zone started the active ABC correction B.

Given the clear daily downtrend, Google can be expected to fall further to the next support level 177.20, former strong support from October and March.