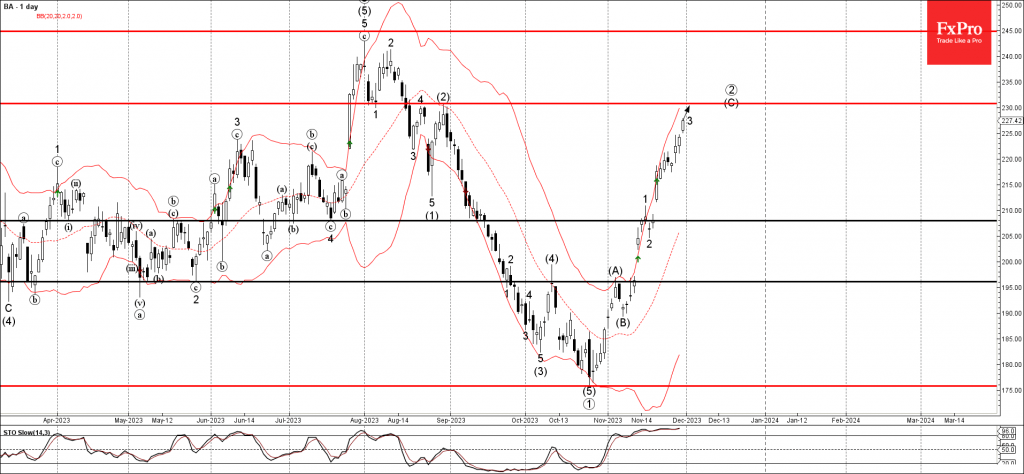

– Boeing rising inside impulse wave 3

– Likely to reach resistance level 230.00

Boeing rising sharply inside the minor impulse wave 3 of the intermediate impulse wave (C) from the start of November.

The price is currently approaching the resistance level 230.00 (which stopped the previous upward correct ions 4 and (2) in August).

Given the strength of the active impulse waves 3, (C) and the prevailing risk on sentiment seen across the US stock markets, Boeing can be expected to rise further to the next resistance level 230.00 (target for the completion of the active wave (C)).