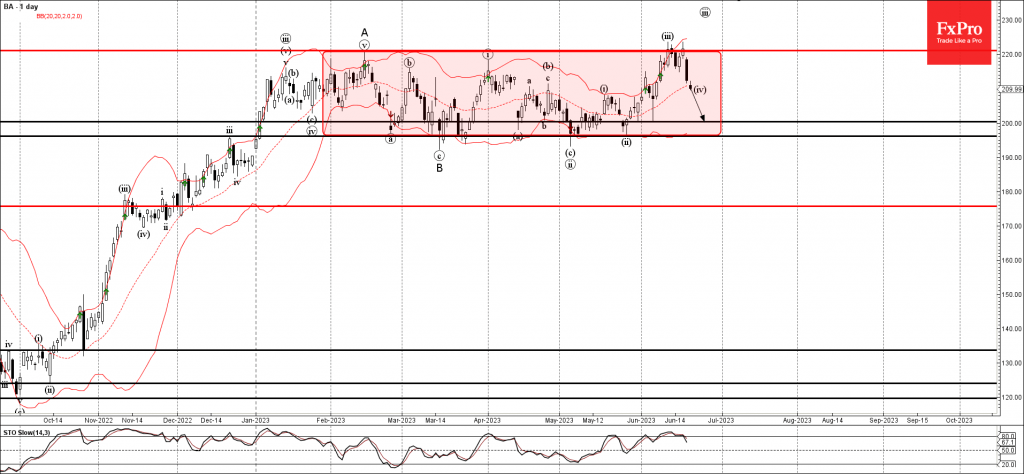

– Boeing reversed from powerful resistance level 220.00

– Likely to fall to support level 200.40

Boeing recently reversed down from the powerful resistance level 220.00, which is the upper border of the sideways price range inside which the price has been trading from February.

The downward reversal from the resistance level 220.00 started the active short-term correction (iv).

Given the strength of the resistance level 220.00 , Boeing can be expected to fall further to the next support level 200.40 (low of the daily Hammer from the start of this month).