– Boeing reversed from support area

– Likely to rise to resistance level 196.00

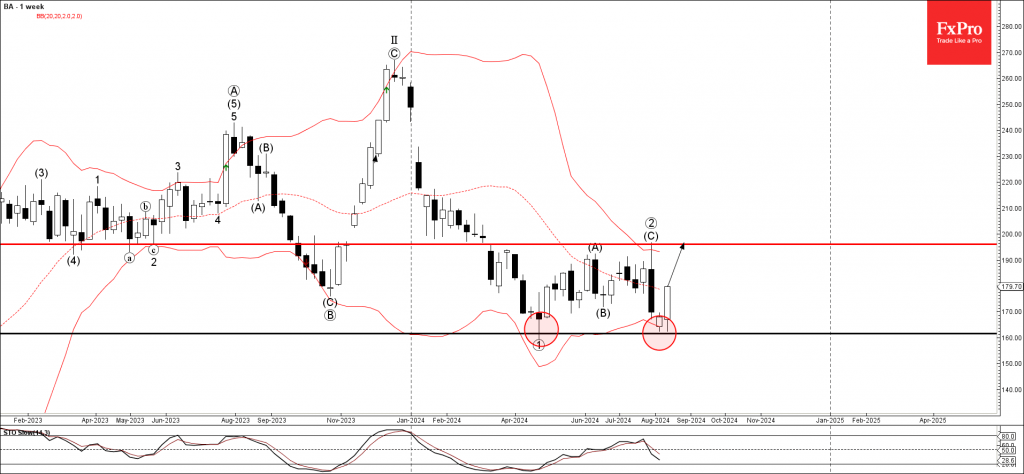

Boeing recently reversed up from the strong support area located between the support level 161.60 (which stopped the weekly wave 1 April) and the lower weekly Bollinger Band.

The upward reversal from this support area is likely to form the weekly Morning Star – strongly signal for Boeing.

Given the strength of the support level 161.60 and the bullish divergence on the weekly Stochastic, Boeing can be expected to rise further toward the next resistance level 196.00.