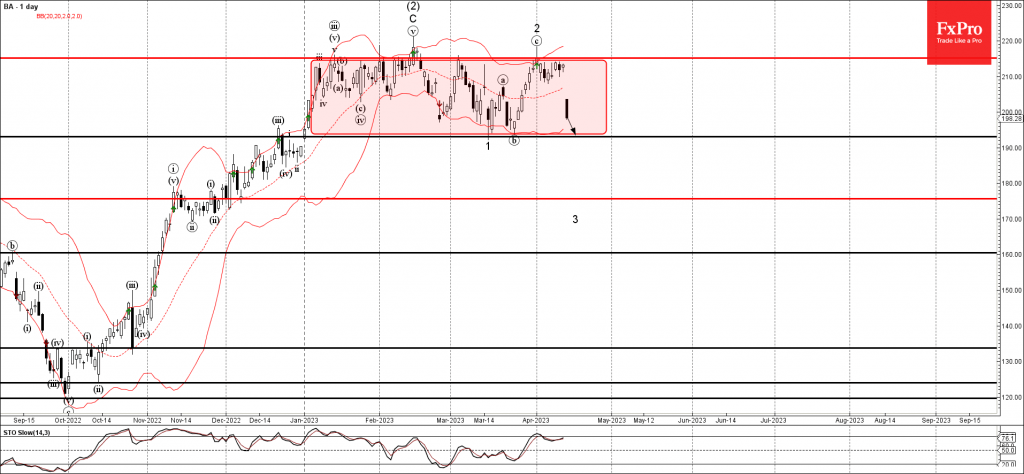

• Boeing falling inside impulse waves 3 and (3)

• Likely to reach support level 193.10

Boeing continues to fall inside the minor impulse wave 3, which belongs to the intermediate impulse wave (3) from February.

Both of the active impulse waves 3 and (3) started from the resistance level 215.00, which is the upper boundary of the sideways price range inside which the price has been trading from January.

Boeing can then be expected to fall further toward the next support level 193.10 (low boundary of the active sideways price range).