BNB: ⬆️ Buy

– BNB reversed from support area

– Likely to rise to resistance level 117325.00

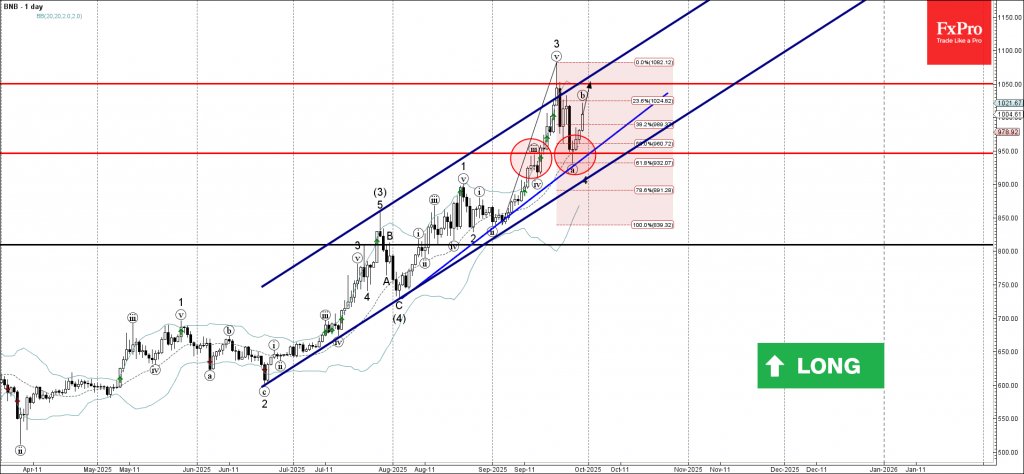

BNB recently reversed from the support area between the support level 950.00 (former resistance from the middle of September), 20-day moving average, support trendline from August and the 61.8% Fibonacci correction of the upward impulse from the start of September.

The upward reversal from this support area created the daily Japanese candlesticks reversal pattern Doji, which started the active short-term corrective wave (b).

Given the strong daily uptrend, BNB can be expected to rise to the next resistance level 1050.00 (which stopped earlier impulse wave 3).