Brent Crude oil ⬆️ Buy

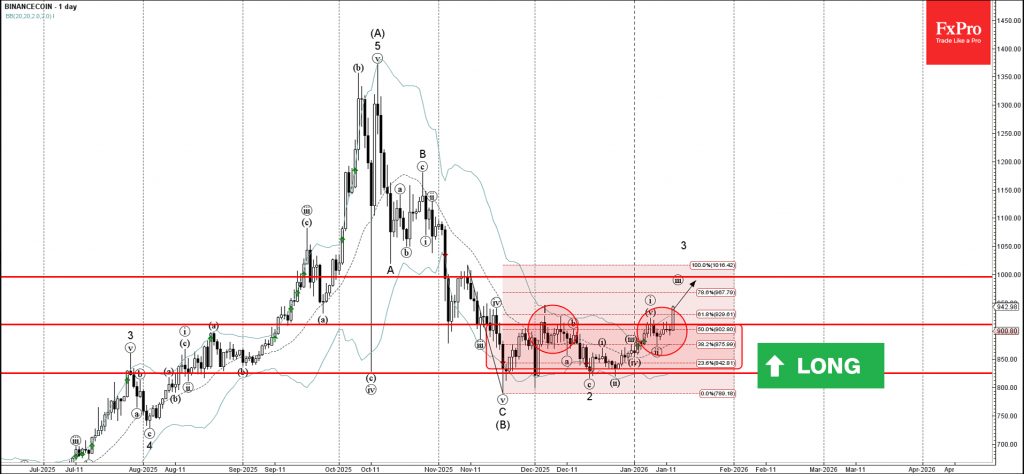

– BNB broke out of sideways price range

– Likely to rise to resistance level 1000.00

BNB recently broke the resistance area between the resistance level 910.00 (upper border of the sideways price range from November) and the 50% Fibonacci correction of the downward impulse from November.

The breakout of this resistance area accelerated the active impulse wave iii – which belongs to the medium-term impulse wave (C) from November.

BNB can be expected to rise to the next round resistance level 1000.00 (target for the completion of the active impulse wave iii).