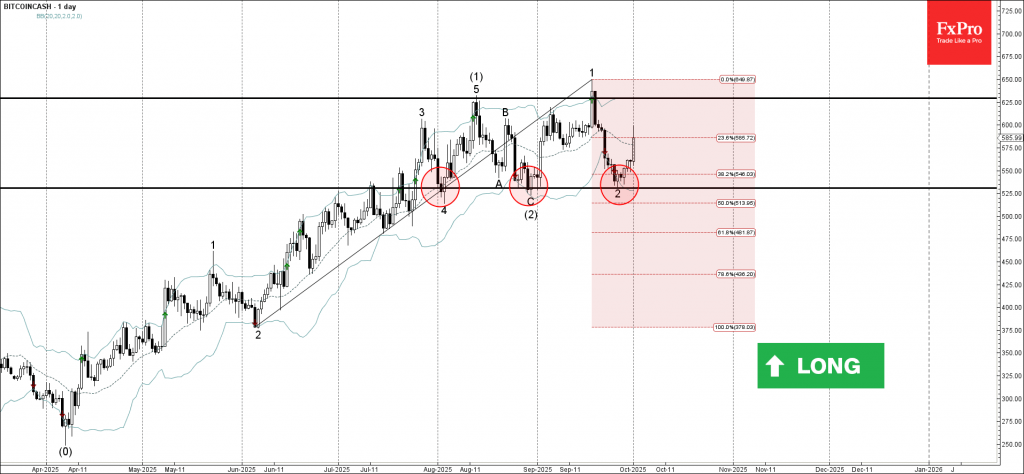

BitcoinCash: ⬆️ Buy

– BitcoinCash reversed from support zone

– Likely to rise to resistance level 0.936

BitcoinCash cryptocurrency recently reversed up from the strong support zone between the pivotal support level 530.00 (which has been reversing the price from the start of August) and the lower daily Bollinger Band.

The support zone was further strengthened by the 38,2% Fibonacci correction of the earlier sharp upward impulse wave from June.

Given the strong daily uptrend, BitcoinCash cryptocurrency can be expected to rise in the active impulse wave 3 to next resistance level 625.00 (which stopped earlier waves (1) and 1).