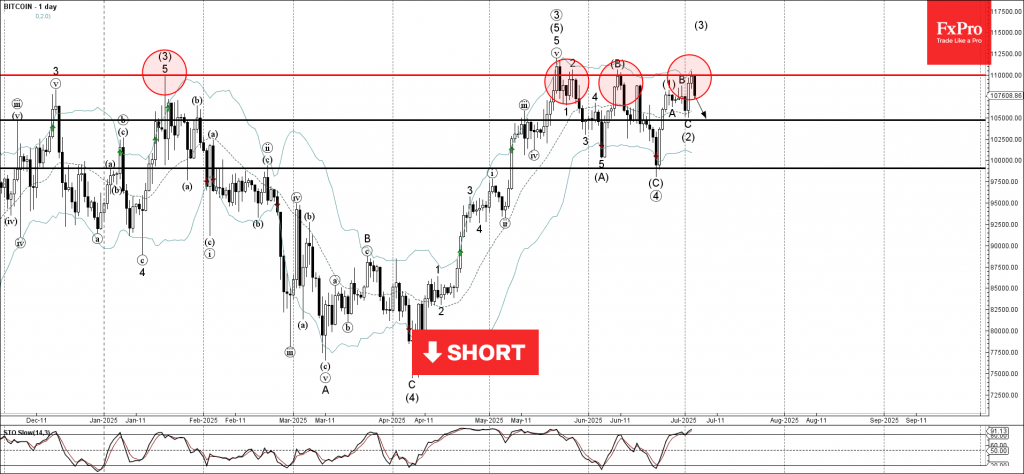

Bitcoin: ⬇️ Sell

– Bitcoin reversed from long-term resistance level 110000.00

– Likely to fall to support level 105000.00

Bitcoin cryptocurrency recently reversed down from the major long-term resistance level 110000.00 (which has been steadily reversing the price from the start of this year, as can be seen below) – intersecting with the upper daily Bollinger Band.

The downward reversal from the resistance level 110000.00 stopped the previous medium-term impulse wave (3) from the start of June.

Given the strength of the resistance level 110000.00 and the overbought daily Stochastic, Bitcoin cryptocurrency pair can be expected to fall to the next support level 105000.00 (low of the previous correction (2)).