Market picture

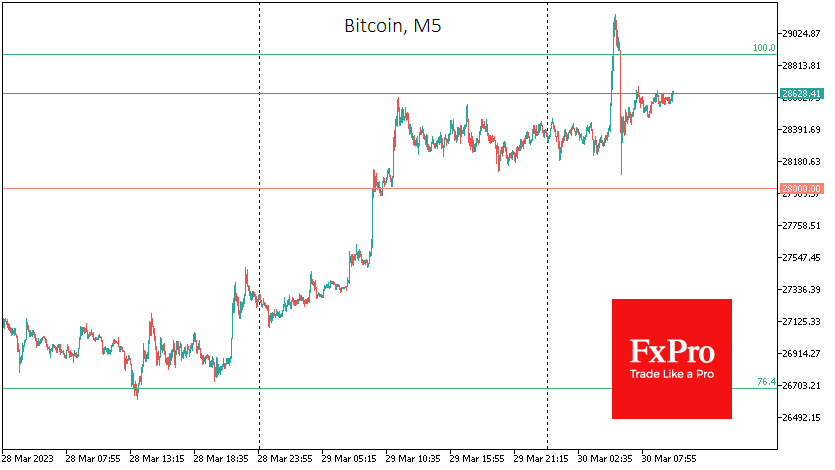

The stock market’s upbeat mood brought the price of bitcoin back to the upper limit of the March trading range. In the low-liquid market early in the morning, Bitcoin picked up a wave of stops moving from $28.5K to $29.1K in minutes. It soon got the reverse traction with the same speed, dropping to $28.0K before entering a smoother intraday uptrend.

The morning breakdown of $29.0K was false, and it is better to wait for a more solid fixation above it to talk about the beginning of a new growth impulse. A potential upside target within the formation is the area near $35K (161.8% of the initial move). However, already near $30K, BTCUSD may face short-term selling pressure.

The XRP token has tested highs since May 2022 above $0.58. So far this week, it has gained more than 20% amid hopes of an optimistic outcome of the Ripple Labs litigation with the SEC and the CFTC calling the leading cryptocurrencies commodities.

News background

Galaxy Digital CEO Mike Novogratz called Bitcoin interesting amid the “build-up of debt-to-GDP” in the US. According to him, the banking crisis in the United States was an “adrenaline rush” for cryptocurrencies and gave the bitcoin community “incredible resilience.”

MEPs approved a limit of 1,000 euros on cryptocurrency transactions for unverified users as part of the fight against money laundering, terrorist financing and sanctions evasion.

According to the Financial Times, Binance hid its connection to China for several years, despite claims from management that the site left the country at the end of 2017.

The FxPro Analyst Team