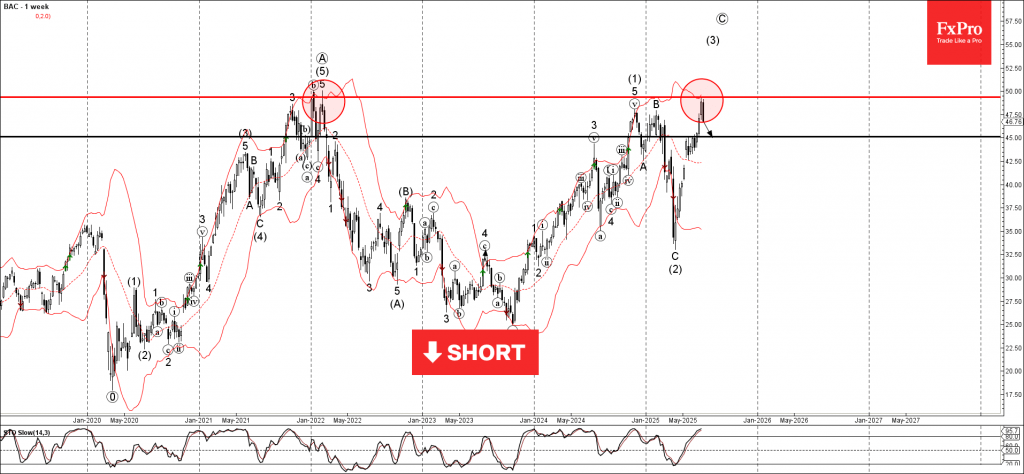

Bank of America: ⬇️ Sell

– Bank of America reversed from resistance area

– Likely to fall to support level 45.00

Bank of America recently reversed down from the resistance area located between the long-term resistance level 50.00 (which started the weekly downtrend at the start of 2022) and the upper weekly Bollinger Band.

The downward reversal from this resistance area stopped the previous intermediate impulse wave (3) from the start of 2025.

Given the strength of the resistance level 50.00 and the overbought weekly Stochastic Bank of America can be expected to fall to the next support level 45.00.