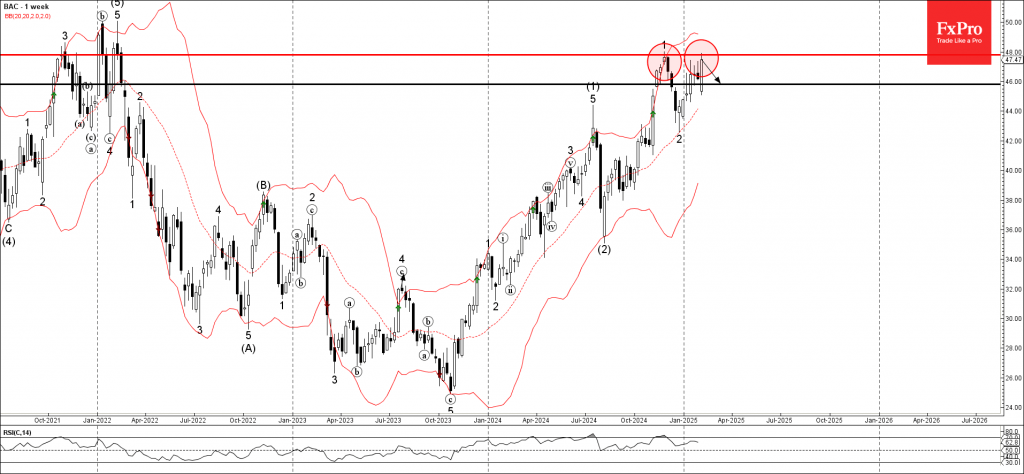

– Bank of America reversed from resistance level 47.80

– Likely to fall to support level 46.00

Bank of America recently reversed down from the resistance zone located between the major resistance level 47.80 (which also stopped the earlier minor impulse wave 1 at the end of last year) and the upper weekly Bollinger Band.

The previous downward reversal from the resistance level 47.80 created the daily Japanese candlesticks reversal pattern Evening Star.

Given the strength of the resistance level 47.80 and the bearish divergence on the daily RSI, Bank of America can be expected to fall to the next support level 46.00.