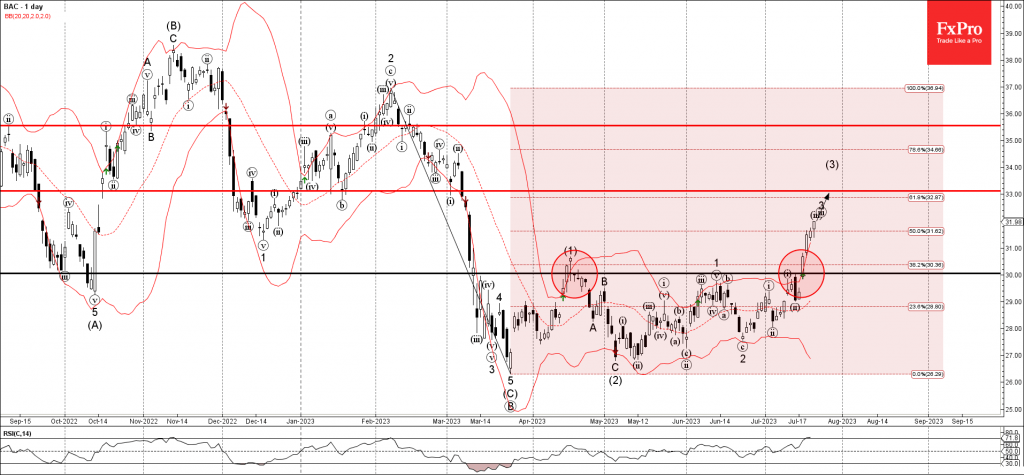

– Bank of America rising inside impulse wave 3

– Likely to reach resistance level 33.00

Bank of America continues to rise inside the short-term upward impulse wave 3, which belongs to the intermediate impulse wave (3) from the start of May.

The price earlier broke above the round resistance level 30.00 (which has been reversing the price from April) – which accelerated the active impulse wave 3.

Bank of America can be expected to rise further toward the next resistance level 33.00 (former support from January and March).