– AUDUSD reversed from support level 0.6350

– Likely to rise to resistance level 0.6500

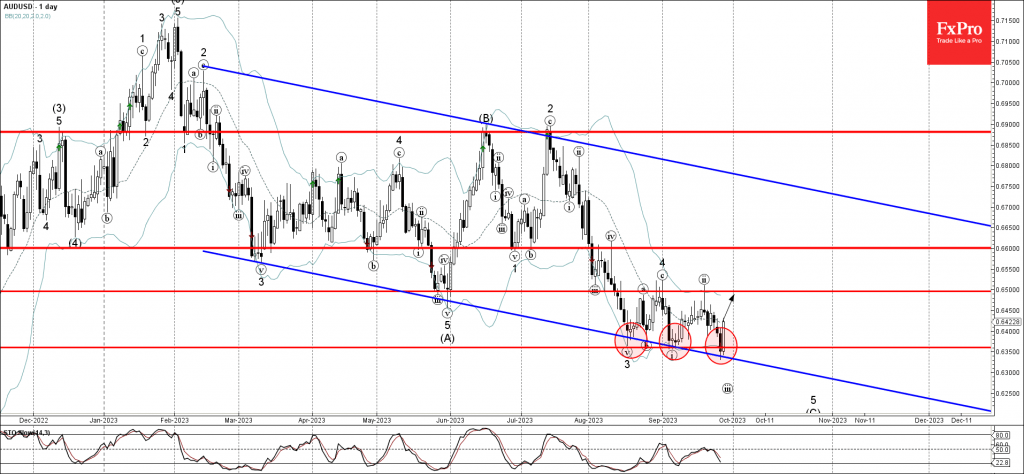

AUDUSD currency pair recently reversed up from the key support level 0.6350 (which has been reversing the price from the middle of August) intersecting with the lower daily Bollinger Band and the support trendline of the wide down channel from February.

The upward reversal from the support level 0.6350 is likely to form the daily candlesticks reversal pattern Bullish Engulfing.

Given the bullish divergence on the daily Stochastic indicator, AUDUSD currency pair can be expected to rise further toward the next resistance level 0.6500 (which stopped the previous waves (a), 4 and (ii)).