– AUDUSD reversed from pivotal support level 0.6450

– Likely to rise to resistance level 0.6550

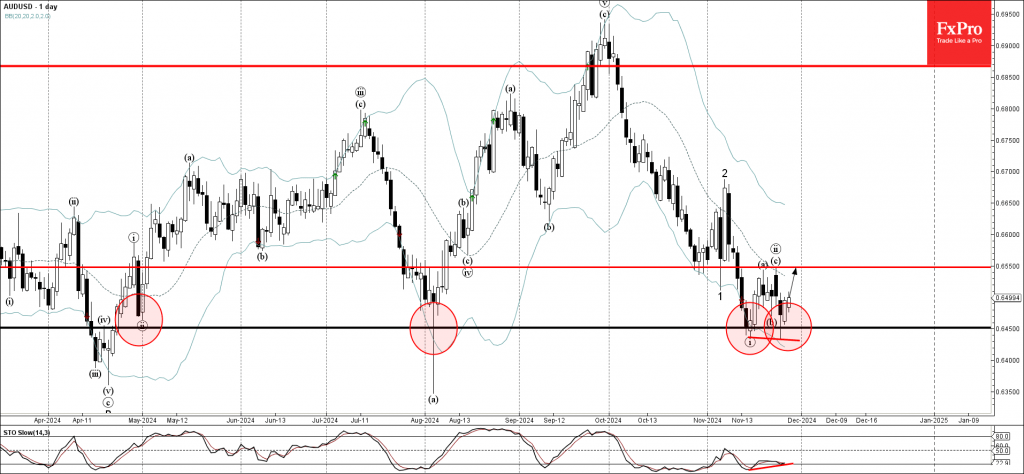

AUDUSD currency pair recently reversed up from the pivotal support level 0.6450 (which has been reversing the price from April) standing near the lower daily Bollinger Band.

The upward reversal from the support level 0.6450 formed the daily Japanese candlesticks reversal pattern Bullish Engulfing. This support level also formed the daily Morning Star earlier this month.

Given the strength of the support level 0.6450 and the bullish divergence on the daily Stochastic, AUDUSD currency pair can be expected to rise to the next resistance level 0.6550 (top of the previous correction ii).