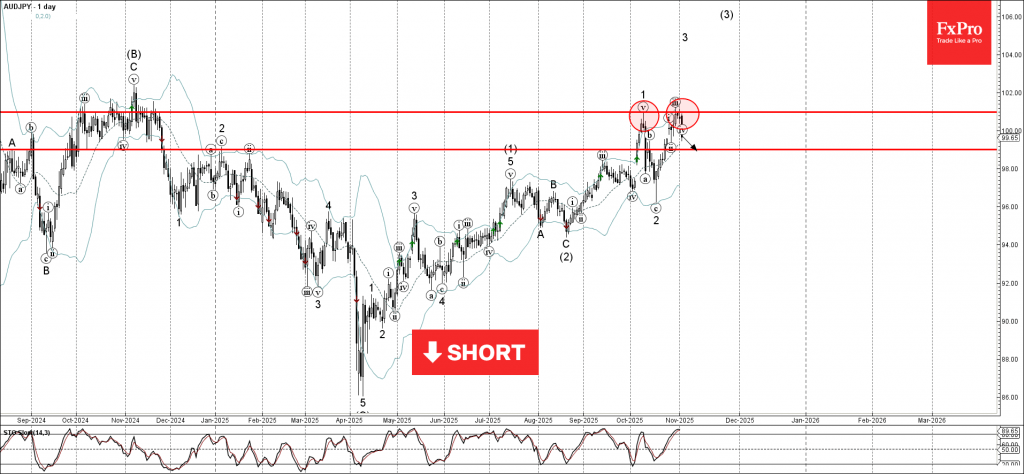

AUDJPY: ⬇️ Sell

– AUDJPY reversed from key resistance level 101.00

– Likely to fall to support level 99.00

AUDJPY currency pair recently reversed from the resistance zone between the key resistance level 101.00 (which stopped the previous minor impulse wave 1 at the start of October) and the upper daily Bollinger Band.

The downward reversal from this resistance area created the daily Japanese candlesticks reversal pattern Evening Star Doji – which stopped the previous impulse waves 3 and (3).

Given the strength of the resistance level 101.00 and the overbought daily Stochastic indicator, AUDJPY currency pair can be expected to fall to the next support level 99.00.