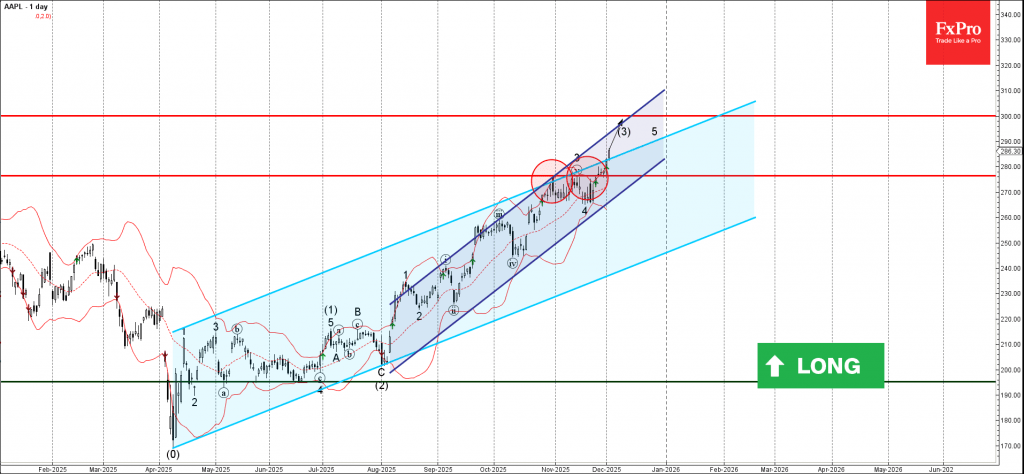

Apple: ⬆️ Buy

– Apple broke the resistance level 276.00

– Likely to rise to resistance level 300.00

Apple recently broke the resistance level 276.00 (which stopped the previous minor impulse wave 3) intersecting with the resistance trendline of the daily up channel from April.

The breakout of the resistance level 276.00 accelerated the active impulse wave 5 of the intermediate impulse sequence (3) from August.

Given the strong daily uptrend, Apple can be expected to rise further to the next round resistance level 300.00 (target price for the completion of the active impulse wave (3)) intersecting with the daily up channel from August.