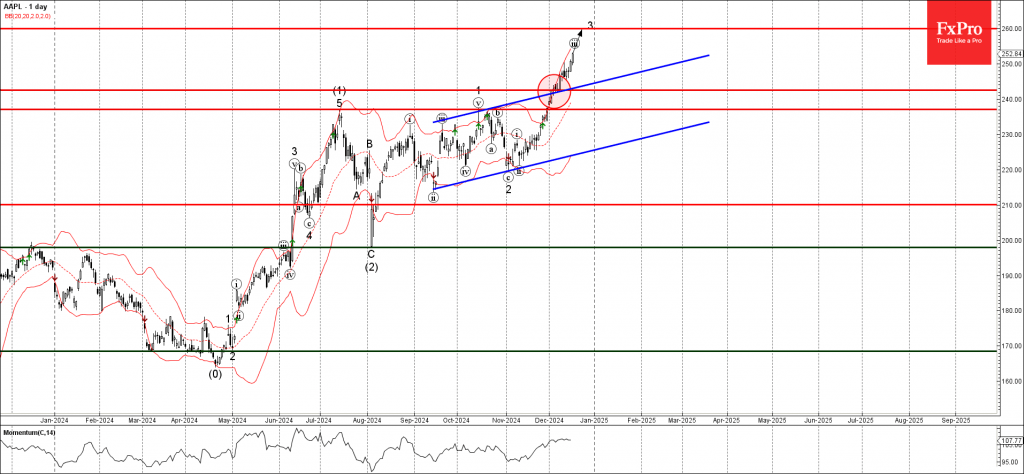

– Apple rising inside impulse wave 3

– Likely to reach resistance level 260.00

Apple continues to rise inside the accelerated impulse wave 3, which previously broke the resistance zone located between the resistance level 242.00 and the resistance trendline of the daily up channel from the middle of September.

The active impulse wave 3 belongs to the extended upward impulse sequence (3) from the start of August.

Given the clear daily uptrend, Apple can be expected to rise further to the next resistance level 260.00 (target price for the completion of the active impulse wave 3).