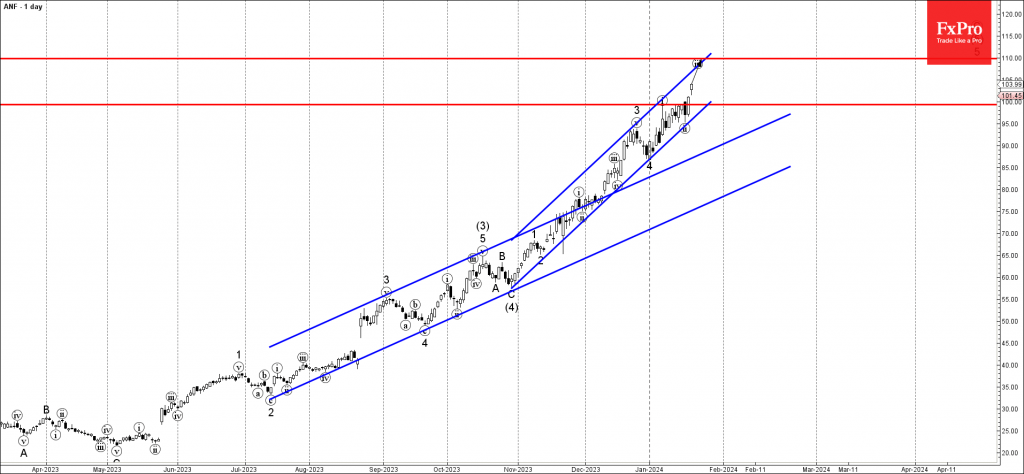

– ANF breaks round resistance level 100.00

– Likely to rise to resistance level 110.00

Abercrombie & Fitch Co under the bullish pressure after the earlier breakout of the round resistance level 100, which stopped the previous minor impulse wave (i) at the start of January.

The breakout of the resistance level 100.00 accelerated the active short-term impulse wave iii of the higher order impulse waves 5 and (5).

Given the very strong daily uptrend, Abercrombie & Fitch Co can be expected to rise further to the next resistance level 110.00, target for the completion of the active impulse wave iii.