– Amazon reversed from key support level 144.00

– Likely to rise to resistance level 155.00

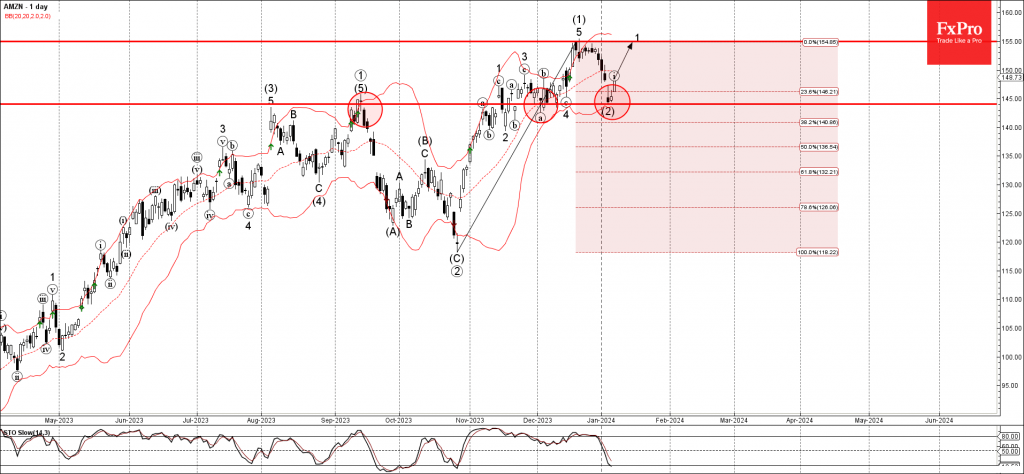

Amazon recently reversed up from the key support level 144.00 (former multi-month resistance level from September).

The support level 144.00 was strengthened by the lower daily Bollinger Band and by the 38.2% Fibonacci correction of the upward impulse (1) from October.

Given the clear daily uptrend, Amazon can be expected to rise further to the next resistance level 155.00 (top of wave (1) and the target for the completion of the active impulse 1).