Market Picture

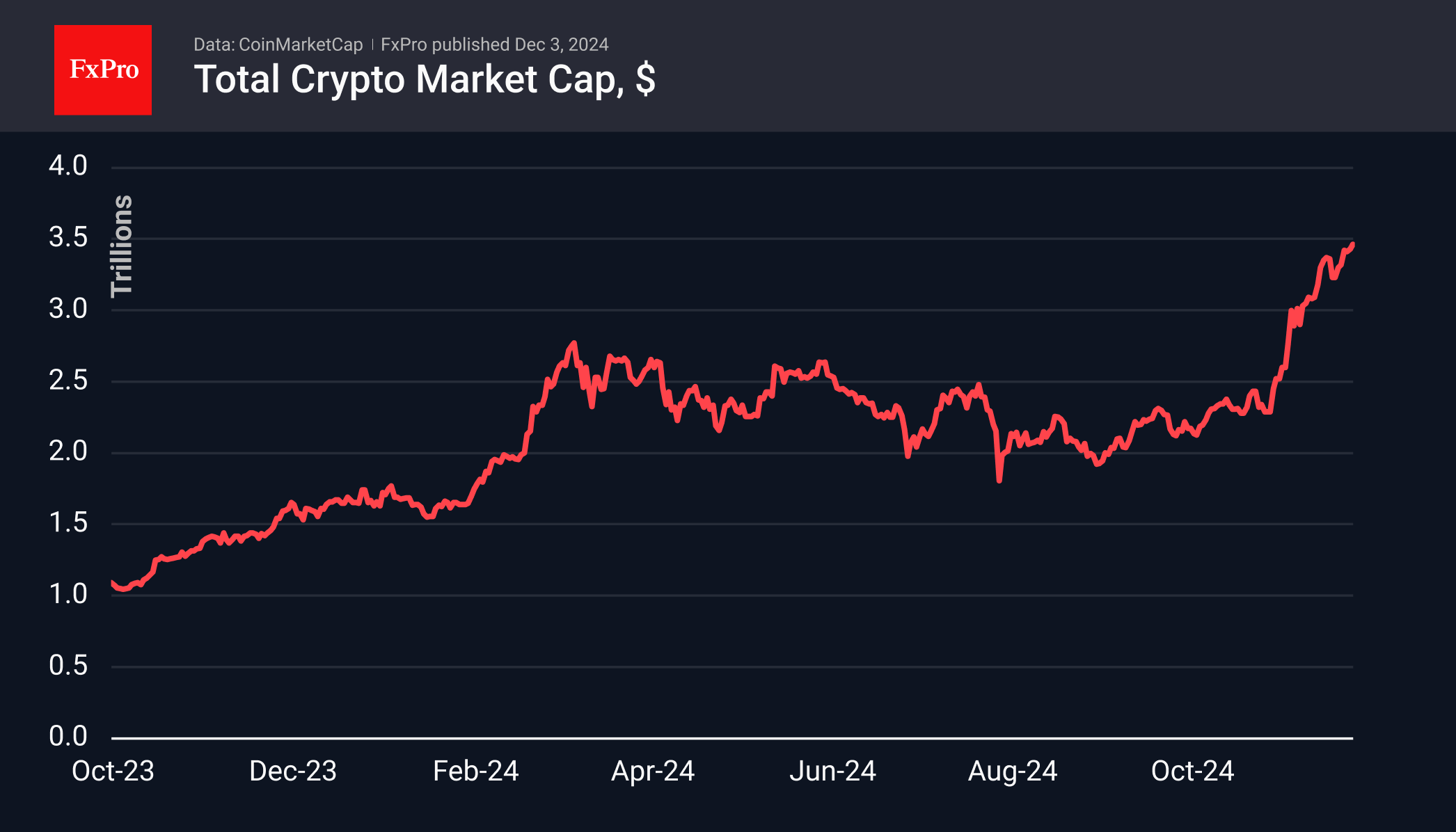

The cryptocurrency market is up 0.1% over the past 24 hours, but a closer look reveals that the market has hit resistance at $3.50 trillion twice since the beginning of the week, pulling back to the current $3.46 trillion.

While Bitcoin remains range-bound and unable to break through $100,000, it’s altcoin season, according to the CoinMarketCap index. The index hit 83 at the start of the day on Tuesday, an impressive rise from 23 a month ago.

Thanks to altcoins, the crypto market’s extreme greed sentiment continues. The corresponding index is at 76, and it has ranged between 75 and 84 over the past week.

Bitcoin is consolidating in the $100,000 area. Last week, an attempt was made to break below $90,000, but the momentum is mostly between $95,000 and $98,000.

The rocket of the month has been XRP, which has quadrupled in price over this period. Its capitalisation is approaching $150 billion, which is already more than Tether at $135 billion and Solana at just over $100 billion. Above the last peak of $2.9, XRP spent less than 12 hours at the beginning of 2018. The price has now stabilised at $2.6, where it spent around a week almost six years ago. It’s reasonable to expect a correction at this level as well.

In addition to waiting for a change in leadership at the SEC and a possible dismissal of the lawsuit against Ripple, market participants are also anticipating the expansion of the list of crypto ETFs for XRP-related products.

News Background

According to CoinShares, global investment in cryptocurrency funds rose by $370 million last week, following a record $3.124 billion inflow the week before. The positive trend continued for the eighth week in a row. Bitcoin investment decreased by $457 million, Ethereum investment increased significantly by $634 million, and XRP increased by a record $95 million.

Bitcoin balances on major exchanges are rapidly shrinking to historic lows, and long-term holders of the first cryptocurrency are in no hurry to enter the market with it, exacerbating the supply shortage, 10x Research noted.

Ethereum is showing the bullish pattern that Bitcoin had before the November rally, said CoinDesk analyst Omkar Godbole. The cryptocurrency’s eight-month correction has come to an end.

MicroStrategy bought an additional 15,400 BTCs for $1.5 billion at an average price of $95.976, founder Michael Saylor said. The coin purchase was funded by the sale of 3.7 million shares of the company’s stock on the open market. MicroStrategy now owns 402,100 BTC, valued at approximately $23.4 billion ($58,263 per coin).

The FxPro Analyst Team