– Alibaba Group broke resistance zone

– Likely to rise to resistance level 120.00

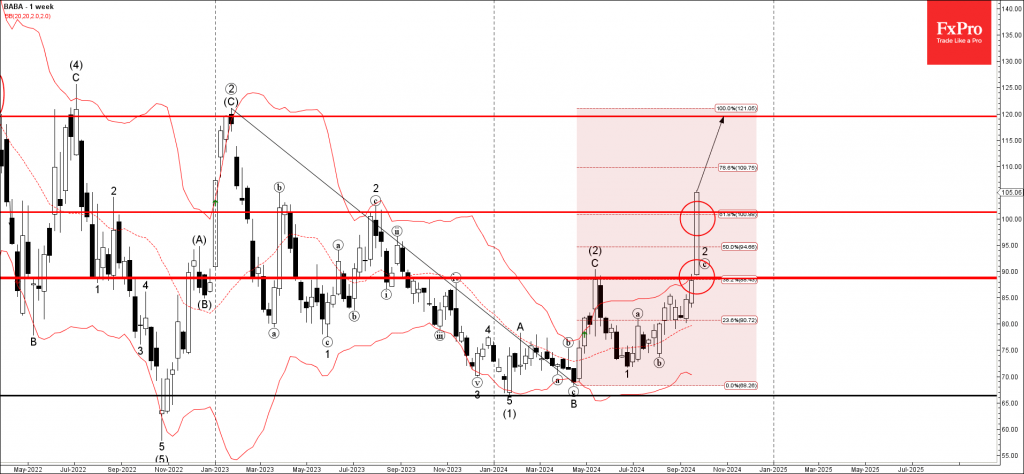

Alibaba Group under the bullish pressure after breaking the resistance zone lying between the key resistance level 101.25 (which also reversed the price in the middle of 2023) and the 61.8% Fibonacci correction of the weekly downtrend from last year.

The breakout of this resistance zone should further accelerate the active wave 2, which earlier broke the round resistance level 90.00.

Given the strength of the active wave 2, Alibaba Group can be expected to rise further to the next resistance level 120.00 (former yearly high from the start of 2023).