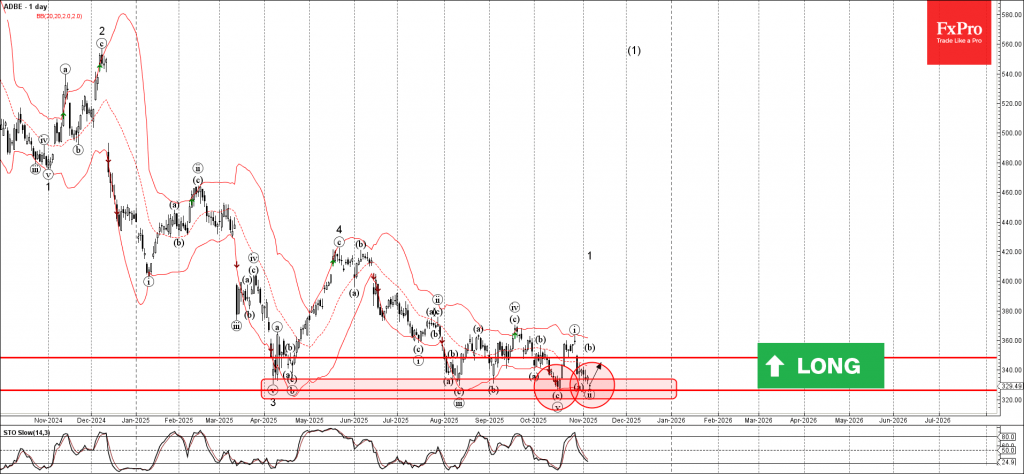

Adobe: ⬆️ Buy

– Adobe reversed from support area

– Likely to rise to resistance level 350.00

Adobe recently reversed from the support area surrounding the key support level 327.00 (which has been reversing the price from April) – strengthened by the lower daily Bollinger Band.

The upward reversal from the support area formed the daily Japanese candlesticks reversal pattern Hammer, which stopped the earlier ABC correction (ii) from the end of October.

Given the strength of the support level 327.00 the bullish divergence on the daily Stochastic indicator, Adobe can be expected to rise to the next resistance level 350.00.