– Abercrombie & Fitch rising strongly

– Likely to rise to resistance level 140.00

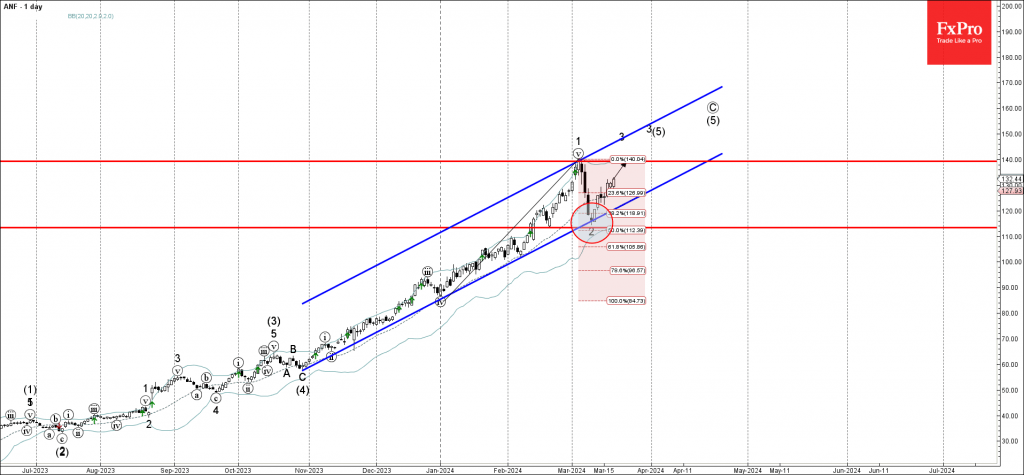

Abercrombie & Fitch previously reversed up with the daily Morning Star from the key support level 137.40 (which also reversed the price in February) intersecting with the support trendline of the daily up channel from October.

The upward reversal from the support level 137.40 started the active impulse wave 3, which is a part of the higher order impulse wave (5) from October.

Given very sharp daily uptrend, Abercrombie & Fitch can be expected to rise to the next resistance level 140.00, which stopped the price at the start of this month.