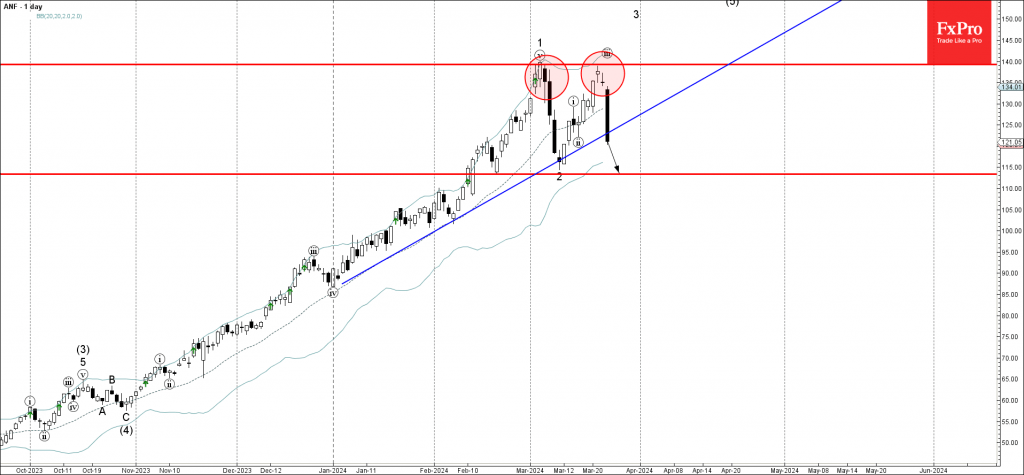

– Abercrombie & Fitch Co reversed from resistance level 140.00

– Likely to fall to support level 115.00

Abercrombie & Fitch Co recently reversed down with two daily Dojis from the pivotal resistance level 140.00, which stopped the previous impulse wave 1 in March.

The resistance level 140.00 was strengthened by the upper daily Bollinger Band.

Given the strength of the resistance level 140.00, Abercrombie & Fitch Co can be expected to fall further to the next support level 115.00 (which stopped the previous corrective wave 2).