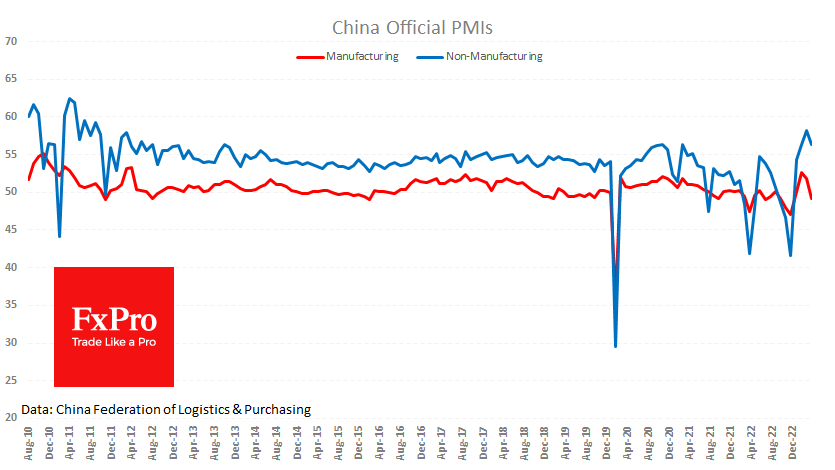

China’s PMIs released over the weekend were much weaker than expected, with the manufacturing index signalling a downturn.

The official manufacturing PMI fell to 49.2 in April from 51.9 the previous month and 51.4 expected. This sudden drop suggests that the economy has lost momentum much more quickly than analysts had expected, following a brief boom at the end of last year as the zero-coupon policy was rolled back. The publication’s commentary suggests a contraction in manufacturing demand after several months of rapid growth.

Historically, last month’s levels are nothing to write home about. This sets the mood that Chinese manufacturing activity is close to stagnating or even deteriorating, with a downtrend from 2018 despite a very bumpy road due to COVID-19.

The non-manufacturing sector feels much better, losing 1.8 percentage points over the month to 56.4. The long history clearly shows that the growth rate of the non-manufacturing sector has long been a drag on the economy.

Traditionally, market participants pay more attention to production dynamics as it sheds light on global trends and allows for assessing export and import potential, affecting the renminbi exchange rate. Moreover, production often acts as a leading indicator of economic trends.

In this context, it is unsurprising that the renminbi fell, and the USDCNH rose on Monday. Last week it broke above its 200-day MA at 6.95 but did not dare to break through. At the same time, the pullback level to 61.8% of the November and February declines is also in this area.

A decisive break of this long-term trend indicator is likely to be postponed by the outcome of the Fed meeting. A move lower in the USDCNH could be the prologue to a move lower to 6.30 in the coming months. A sharp move higher would reclassify the pair’s rise in recent weeks from a correction to a new advance and could lead to a significant increase in the pair’s volatility.

The FxPro Analyst Team