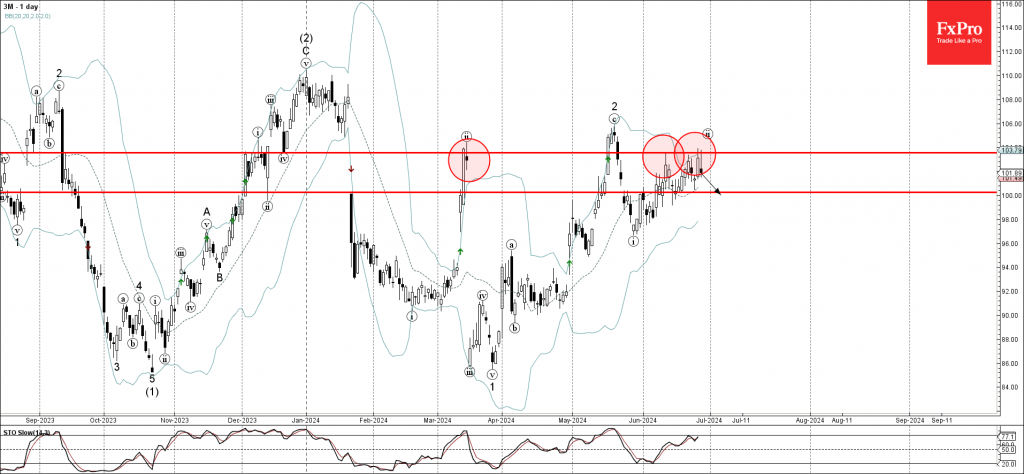

– 3M reversed from strong resistance level 103.55

– Likely to fall to support level 100.00

3M today reversed down once again from the resistance zone set between the strong resistance level 103.55 (which has been reversing the price from March) and the upper daily Bollinger Band.

The downward reversal from this resistance zone is likely to form the daily Japanese candlesticks reversal pattern Shooting Star – if 3M closes this week near the current levels.

Given the strength of the nearby resistance level 580.00, 3M can be expected to fall further toward the next round support level 100.00, which has been reversing the price from the start of June.