Market Overview

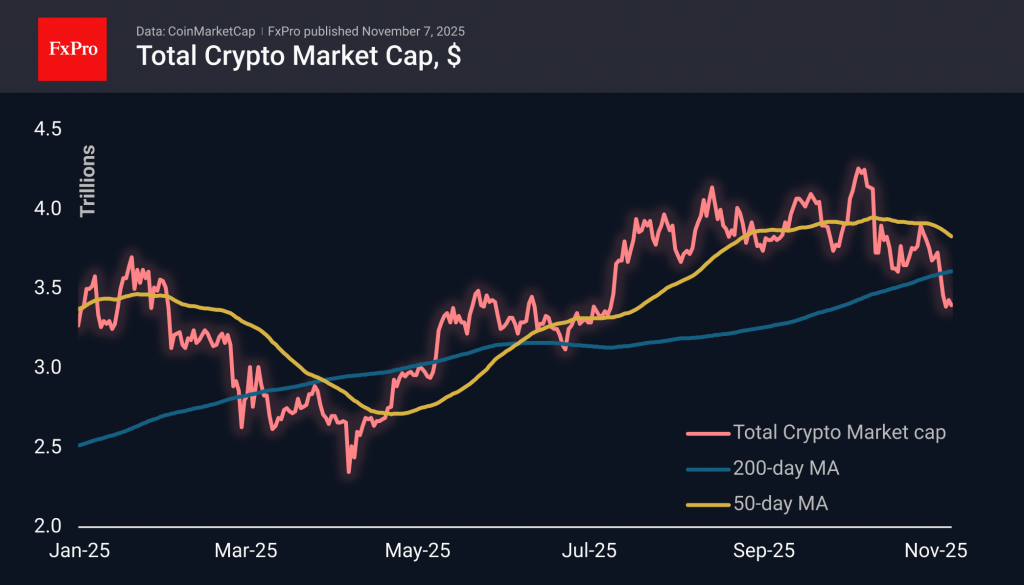

Over the past day, the crypto market has lost the 1% it gained the previous day, reverting to $3.4 trillion, the level of local lows that served as resistance in the middle of the year.

Bitcoin has managed to stay above $100K, with an apparent increase in buying as it approaches this psychologically important round level. Moreover, BTC continues to hover around the 50-week moving average. A consolidation below this level would be a clear sign of a reversal. Most likely, sellers have not yet fully satisfied their interest, preferring to unload at higher levels.

Zcash maintains its double-digit growth rate, adding 24% in the last 24 hours, and is close to becoming the 12th largest (excluding stablecoins) with a capitalisation above $10 billion. The previous time ZEC was worth more than $630 was in November 2016. However, the peak value of $5,941 clearly shows how sharp the growth of less liquid coins can be.

Another analogy is also valid. ZEC is skyrocketing as the bull cycle reaches its final stage, following BTC’s highs, which are likely to mark the peak for the coming years. Mistaking this for the start of a new altcoin season could be a very costly error.

News Background

Bitcoin has lost its key support level, the 365-day moving average, at $102K, according to CryptoQuant. The break of this line in December 2021 and January 2022 was one of the final signals marking the start of the previous bear market. This indicator is roughly equivalent to the 200-day moving average commonly used in traditional finance to track long-term market trends.

Companies with crypto assets on their balance sheets (DAT) should move to implement complex strategies; otherwise, they will ultimately lose out to ETFs, according to Bitwise. Saylor’s company Strategy, which uses debt instruments to increase positions, can serve as an effective crypto treasury.

The Ethereum ecosystem has set a new all-time high for transactions per second (TPS). According to Growthepie, the figure reached 24,192 after including data from the L2 network of the decentralised exchange Lighter in the statistics.

The FxPro Analyst Team