Market picture

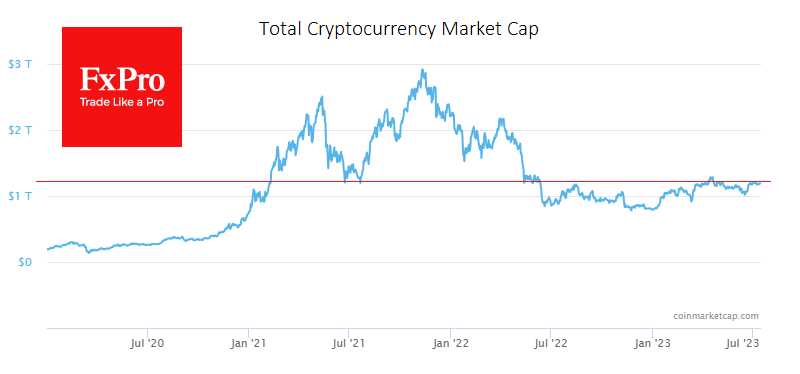

Crypto market cap rose 5.5% in the last 24 hours to $1.25 trillion, a level last seen briefly in April. After touching this level, the market gained strong support from June 2021 to June 2022. But since June 2022, strong support has turned into resistance, bringing sellers back into the game. And now, the critical question is, will the market manage to cross this line to the upside? More likely, yes than no.

On Thursday, bitcoin hit its highest level since early June 2022, near $31,800, on the back of Ripple’s victory in its case against the SEC. The first cryptocurrency has moved above the top of its trading range for the past four weeks, but it still needs to be comfortable in thin-air territory.

The XRP token doubled in value at one point, rising to $0.93, before retreating to $0.77, up 65% in the last 24 hours. The coin has regained fourth place in market capitalisation, and the ripple effect is spreading to altcoins, suggesting that the market has been given an important precedent.

A Southern District of New York court said that XRP sold to retail investors were not securities. However, the court ruled that institutional sales of XRP could still qualify as sales of unregistered securities. The judge’s decision is not final, and the SEC may appeal.

News background

The SEC has filed a lawsuit against bankrupt cryptocurrency lender Celsius. Its former CEO Alex Mashinsky has been arrested as part of the investigation into the company’s collapse. He is accused of fraud and market manipulation, and the company’s token has been recognised as a security.

Brian Armstrong, Coinbase CEO, suggested that Bank of America had begun blocking accounts used by customers to transact with the exchange. In a Twitter poll, around 9% of respondents confirmed the exchange chief’s suspicions.

Barclays, one of the UK’s largest banks, downgraded Coinbase, citing too few near-term catalysts for the company’s stock growth.

According to PwC, hedge funds are becoming increasingly confident about the sustainability of cryptocurrencies. Some 93% of respondents expect the market capitalisation of digital assets to grow by the end of the year. However, the proportion of hedge funds investing in cryptocurrencies has fallen from 37% to 29% by 2023.

The US authorities have begun moving the first cryptocurrency seized from the Silk Road darknet marketplace. In March 2023, the US government sold 9,861 BTC for $215 million.

The FxPro Analyst Team