Market picture

The cryptocurrency market corrected 0.6% in 24 hours to a total capitalisation of $1.65 trillion. The correction was aided by pressure on global equity markets, which lost ground following the IT giants.

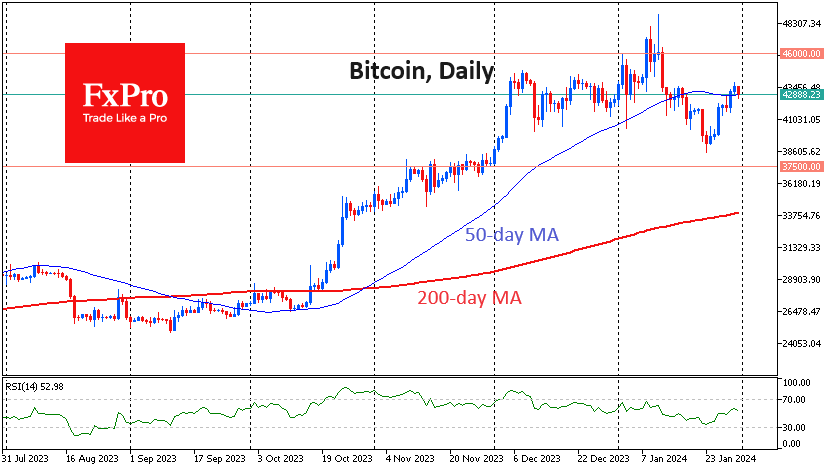

Bitcoin, trading near $43K, remains close to its 50-day moving average. It also ‘rested’ in the same area from the 12th to the 17th of January, so the current calm is not surprising.

Among the top coins, XRP looks the worst, having lost 4% on the day to $0.51. Its sell-off started before the crypto market moved lower. Now, XRP is testing the strength of the support level that has been in place since November 2022 and reflects the transition to active accumulation. A drop to $0.47 would take the price below the recent local lows and mark a break in the uptrend.

It would be too pessimistic to call XRP the canary in the coal mine of the entire crypto market. Most likely, we are in for another change of leadership, and the once promising and popular coin will continue to lag behind its peers.

News Background

Solana broke through the $100 mark amid increased on-chain activity. Since the beginning of the year, Solana’s blockchain has processed $951.9 billion worth of transactions (+30% to December). Solana’s growth comes against a backdrop of significant trading activity in pairs with the WEN meme token and stablecoins.

According to K33 Research, the nine spot bitcoin ETFs launched since 11 January have bought 150,846 BTC worth $6.52 billion, but considering GBTC’s withdrawal from the fund, net inflows into bitcoin exceeded $1 billion. According to The Block, GBTC’s share has fallen from a high of 63.9% (17 January) to a current 36%. In terms of trading volume, crypto fund BlackRock (IBIT) overtook GBTC on Monday.

The SEC accused crypto project HyperFund of defrauding investors of $1.7 billion. The founders promoted HyperFund as an opportunity to “invest in lucrative cryptocurrency mining operations”, but it was a Ponzi scheme with no real sources of income, the SEC said. The project eventually collapsed at the end of 2022, and investors lost money.

In a review of an old criminal case against a major piracy site, German police seized nearly 50,000 BTC ($2.17 billion) from illegal activity. The digital asset seizure was the largest in the country.

The FxPro Analyst Team