Market Overview

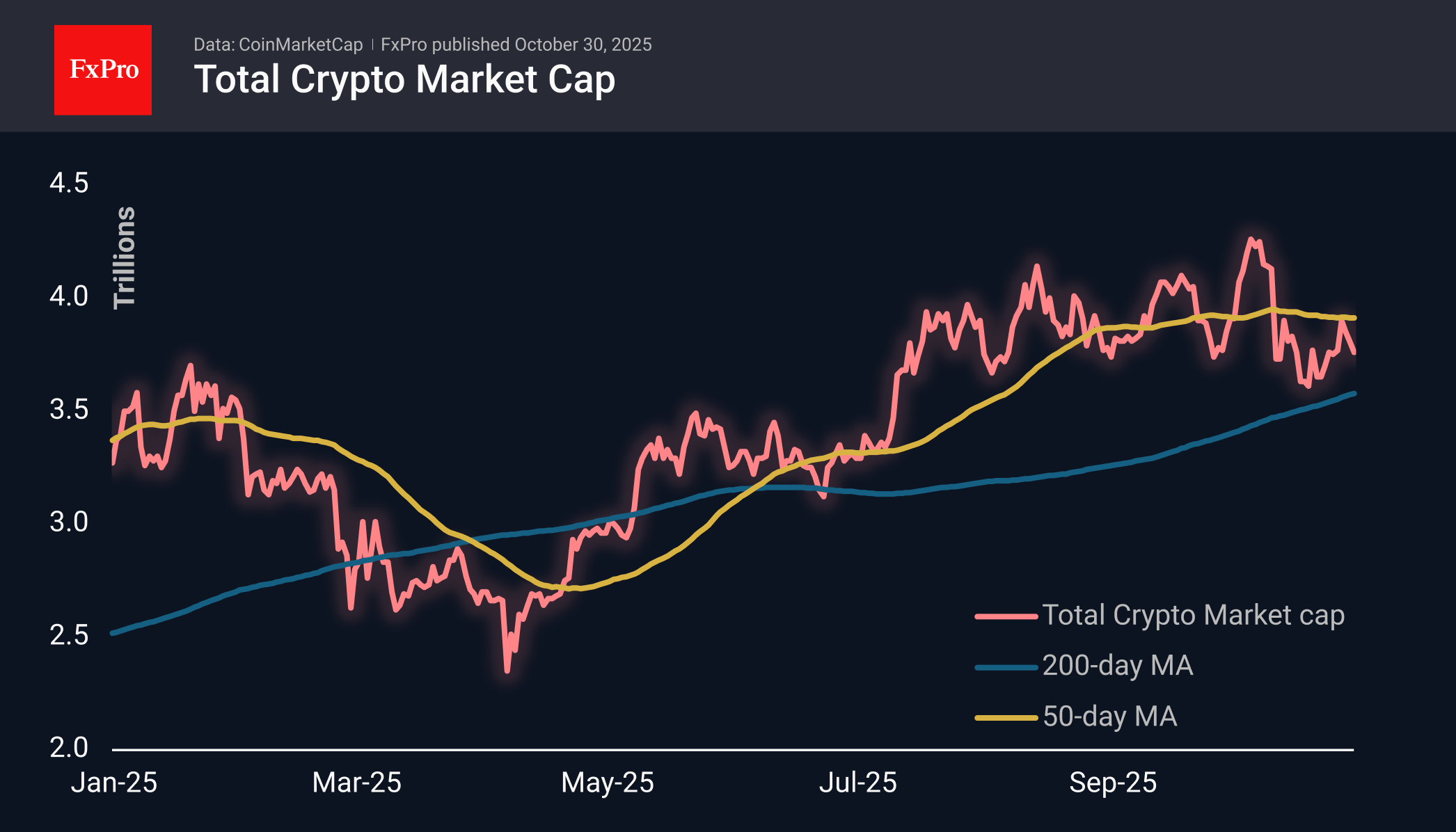

The crypto market cap has been declining for the fourth day, losing another 2% over the past 24 hours and falling back to $3.72 trillion at the time of writing. The growth momentum of the second half of last week did not develop, forming a sequence of lower local highs. However, there have been no significant liquidations, and the overall cap level exceeds the 200-day average.

The sentiment index has fallen back into the fear zone, dropping 34 from neutral values of around 50 in the previous two days. Still, it will take increased volatility and a fall to extreme fear for the indicator to signal a ‘buy opportunity’ according to its design, which implies a potential downside of 4-5%.

Bitcoin volatility has increased since the end of Wednesday due to the reaction to the FOMC comments. The Fed reassured the markets that a rate cut in December is not a foregone conclusion. As a result, the first cryptocurrency is once again hoping for strong support at the 200-day average. In October, the 11th daily candle is touching this line.

News Background

Analyst Axel Adler Jr. anticipates a new Bitcoin rally after the Fed meeting. The growth of stablecoin reserves on Binance relative to Bitcoin reserves creates conditions for an upward trend reversal, according to CryptoQuant.

Glassnode takes a less favourable view of the situation, noting a significant decline in inflows into spot Bitcoin ETFs in the US.

American Bitcoin, co-founded by US President Donald Trump’s son Eric Trump, announced the purchase of 1,414 BTC for $163 million, bringing its total holdings to 3,865 BTC.

Former US Securities and Exchange Commission (SEC) Chairman Gary Gensler has declared Bitcoin’s superiority over other digital assets, acknowledging the growing popularity of the first cryptocurrency among investors.

The French Parliament will consider a bill on Bitcoin reserves. The German Parliament will consider a resolution calling for Bitcoin to be recognised as a unique decentralised digital asset deserving of a strategic approach.

Bitwise has launched a Solana-based spot ETF on the NYSE and intends to allocate 100% of the fund’s assets to staking with an average annual return of 7%. Grayscale Investments will launch a spot Solana ETF with a staking feature on the NYSE on 30 October.

The FxPro Analyst Team