Market picture

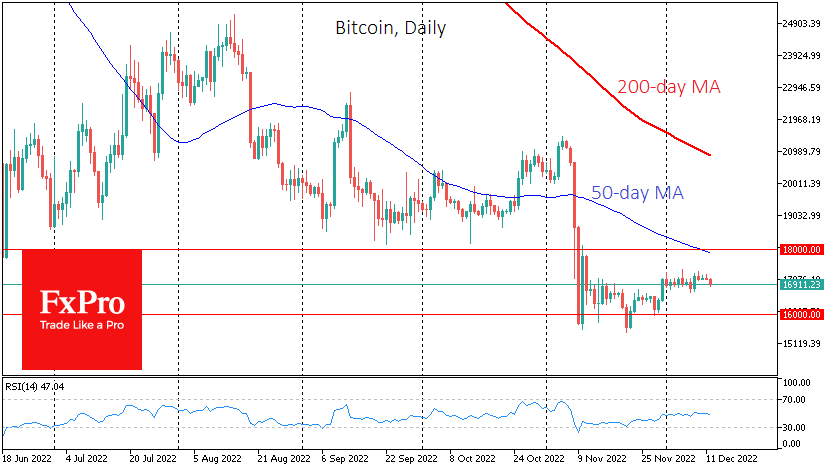

Volatility in Bitcoin and the crypto market remains as squeezed as possible. Continuing to hover near $17K, the price of the first cryptocurrency loses 1.5% in 24 hours, 2.5% in 7 days and is up 1.1% in 30 days.

Total crypto market capitalisation, according to CoinMarketCap, is down 0.5% for the week, to $854bn. The Crypto Fear & Greed Index was unchanged over the week, remaining at 26 points (‘fear’).

On intraday time frames, Bitcoin price remains near the upper end of last week’s range, maintaining (in our view) an equal chance of exiting the corridor in either direction. In both cases, it is prudent to wait for confirmation in the form of a rejection of 1000 one way or the other.

On the bulls’ side is that Bitcoin has been falling for more than a year, having lost three-quarters of its peak price in that time. That is a very attractive disposition for long-term buyers. On the bears’ side is that cryptocurrency is mainly interesting for speculators. With narrowing volatility and no growth, the exit of speculators from the market reduces liquidity, which puts additional pressure on prices on top of caution due to recent major crypto firms’ busts.

News background

According to The Block, there has been a significant decline in developer activity recently on the Ethereum network and other blockchains. The only exception has been the Arbitrum network.

US senators have introduced the Crypto-Assets Environmental Transparency Act, requiring miners to use more than 5MW of electricity to report greenhouse gas emissions.

The US Securities and Exchange Commission (SEC) has required US companies to publicly disclose their cryptocurrency investments and report doing business with any cryptocurrency firms.

The EU has set limits on cash payments of €10,000 to make it more difficult for such payments to be used for criminal purposes. This will make it much more difficult for users to remain anonymous when buying or selling digital assets. In addition, crypto transactions worth more than €1,000 will be audited by virtual asset operators and service providers to combat money laundering.

The FxPro Analyst Team