Market Overview

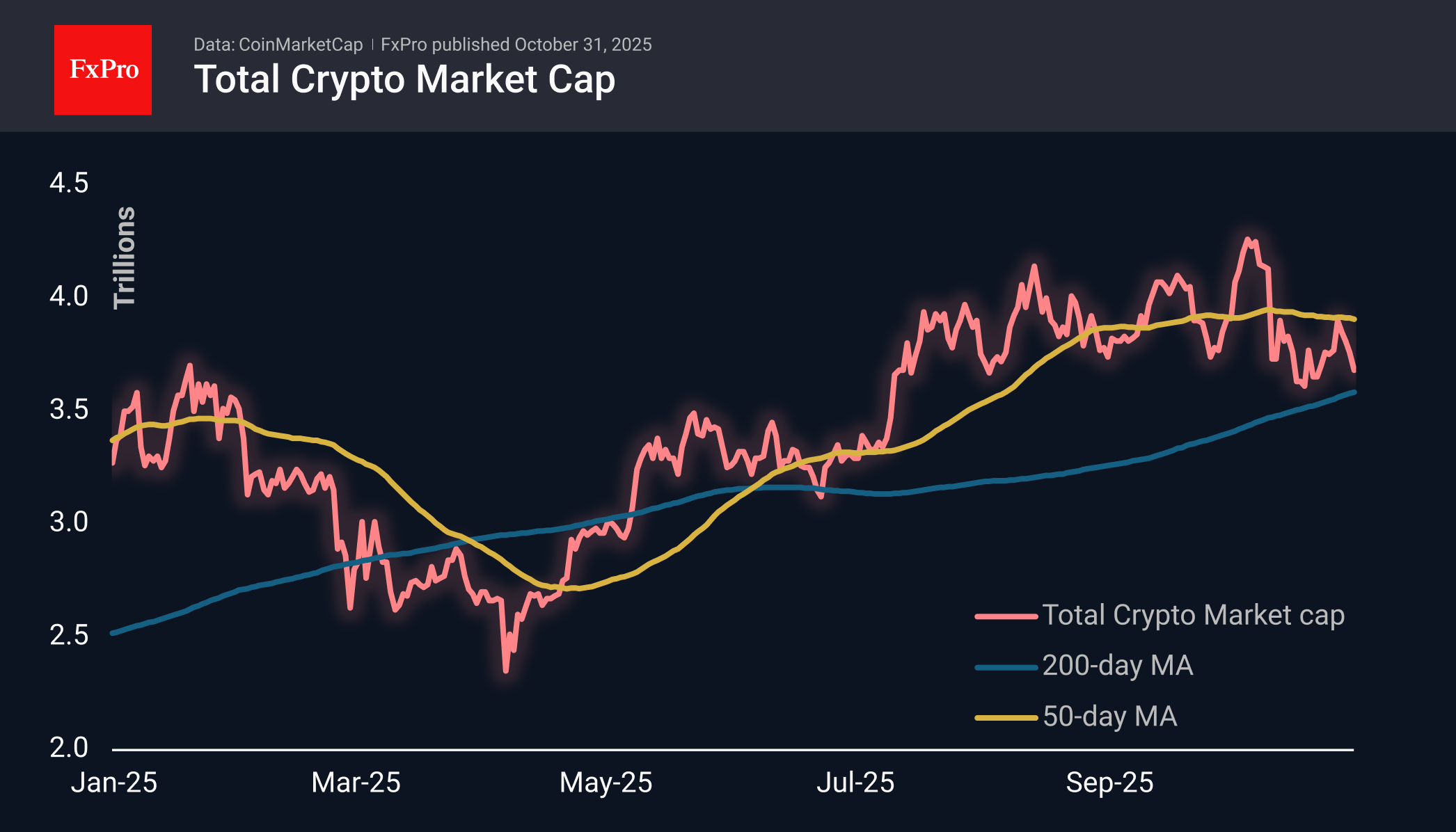

The crypto market cap continues to fall, dropping to $3.58 at the end of the day on Thursday, but stabilising near $3.7 trillion at the beginning of the day on Friday. In other words, we are seeing a local rebound, but each time, lower local highs are being recorded. On the other hand, since July, there have been enough buyers on dips in the $3.5 trillion range.

Bitcoin fell to $106K at the end of the day on Thursday. Attempts to recover on Friday with a return to $110K now look like a rebound. The first cryptocurrency has clearly fallen under stronger gravity in recent days. Perhaps the start of a new month will give buyers a boost. However, the aura of a historically positive month, so-called Uptober, lasted only for the first few days, followed by an impressive decline.

News Background

In recent months, long-term investors have increased their sales of BTC, tripling them from June to October, according to Glassnode. The primary buyers of the asset were investors who purchased Bitcoin at an average price of $93K.

The inability to consolidate above $113K after six months of steady trading at high levels indicates a weakening of buying activity. If the trend continues, a pullback to the next significant support level around $88K is possible, Glassnode warns.

In October, the volume of spot trading in Bitcoin on the largest exchanges reached a record high, exceeding $300 billion, according to CryptoQuant. This indicates an increase in liquidity and market stability.

Strategy founder Michael Saylor said that Bitcoin will reach $150K by the end of the year. His long-term forecast for the next 20 years assumes an average annual growth rate of approximately 30% for BTC.

According to Nansen, on-chain activity on the Ethereum network has risen to a monthly high. Despite this, fees on the ETH network remain near historic lows. The surge in on-chain activity comes amid a deterioration in other indicators. For example, the number of active addresses has been steadily declining since May.

The anonymous cryptocurrency Zcash has grown by 700% in a month due to a surge in ‘demand for privacy.’ The volume of secure transactions in Zcash reached a record 4.9 million ZEC. However, the ZEC price is still 89.2% below its historic high, reached in October 2016 at just under $3,200.

The FxPro Analyst Team