Market picture

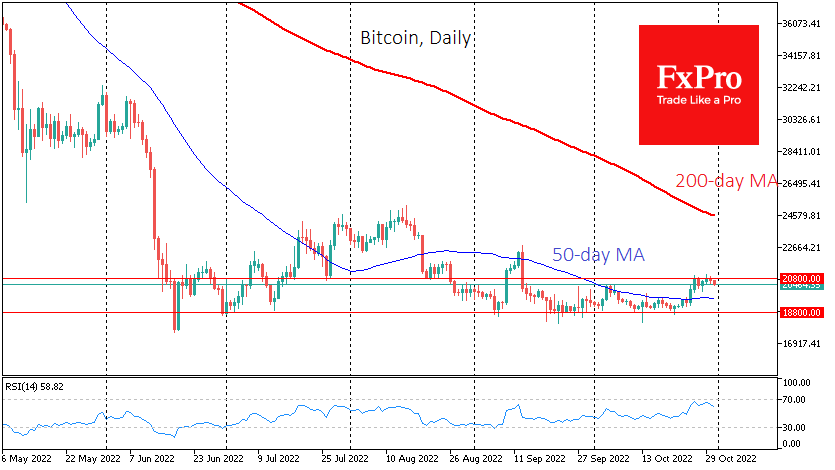

Bitcoin rose 6.2% over the past week, finishing near $20.7K. The bulls over the weekend managed to rewrite local highs (touching levels above $21K) but again triggered a wave of profit-taking, forcing BTCUSD to retreat to the $20.5K area.

Ethereum has gained 18% in seven days, to $1590. Other leading altcoins have gained between 12.5% (BNB) and 98% (Dogecoin). The exception was XRP (-0.4%).

The total capitalisation of the crypto market, according to CoinMarketCap, rose 8.6% for the week to $1.01 trillion. The crypto Fear & Greed Index fell from 34 to 31 by Monday, markedly above 22 a week earlier.

Investors in the crypto market have cheered over the past week, supported by a weaker dollar and a rally in equities. However, there is still a significant overhang of selling triggered at any significant technical levels – previous highs or round levels. This trading mode will likely persist until the FOMC meeting on Wednesday evening but could stretch into weeks.

Dogecoin showed the best momentum, doubling in value in a week after Elon Musk purchased Twitter. DOGE took eighth in the cryptocurrency capitalisation ranking, pushing below Cardano and Solana.

News background

Cardano founder Charles Hoskinson has speculated that Dogecoin could be integrated with Twitter and suggested that the meme cryptocurrency could be moved to the Cardano blockchain to be able to add support for smart contracts.

According to Morgan Stanley, investors are gearing up for a big bitcoin sell-off. According to the bank, investors who bought the cryptocurrency at the top of the market are waiting for the BTC rally to resume to dump the asset at the highest possible price.

The rise in cryptocurrencies will be preceded by an increase in Stablecoin capitalisation, according to Santiment.

According to CryptoCompare, October saw the lowest cryptocurrency trading volume among institutions. However, total assets under management (AUM) across all digital asset investment products rose for the first time since July.

Social network Twitter said it would add a new feature allowing users to buy, sell and display non-fiat tokens (NFTs) directly through tweets.

For the first time, the volume of XRP tokens owned by Ripple Labs fell below 50% of issuance, the company noted in its third-quarter earnings report.

The FxPro Analyst Team