Market picture

The crypto market added 2.8% in the last 24 hours to a total cap of $2.34 trillion, returning to the levels of the start of the week. Bitcoin was up 2.7%, Ethereum +1.8%, with Solana (+7.3%) and Toncoin (+13%) shining once again. The capitalisation of the latter ($23.7B) is approaching the level of XRP ($28.6B). The gap is an impressive 20% but substantially narrowed over the last week as XRP lost 1% while Ton gained 28%.

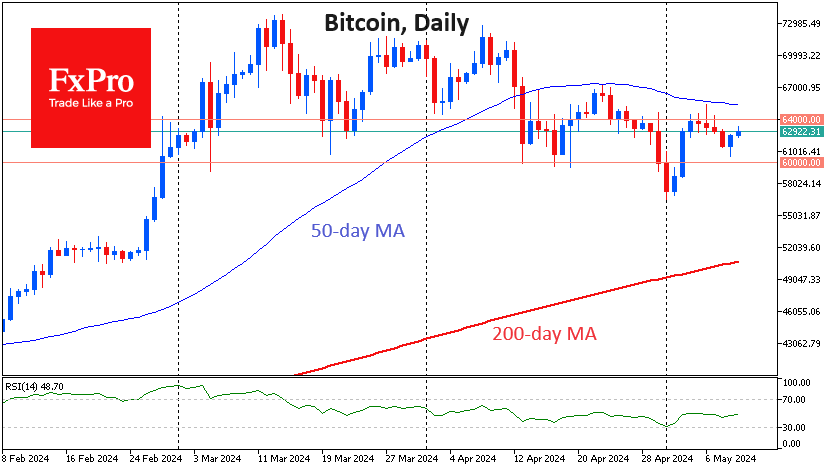

Bitcoin has made two attempts since the start of the day on Friday to break the $63.0K level, which doesn’t look like a meaningful turning point. Much more interest is focused on the $64.0K area on the upside and $60.0K on the downside.

Trading volumes on crypto exchanges declined for the first time in seven months. According to CCData, the combined volume of spot and derivative cryptocurrency markets fell 43.8% to $6.58 trillion in April, following a record high of $9.12 trillion in March.

News background

In another recalculation, the mining difficulty of the first cryptocurrency fell 5.63% to 83.15T, the sharpest decline since December 2022. According to Glassnode, the smoothed 7-day moving average hashrate collapsed to 578.9 EH/s after a record high of 649.7 EH/s on 19 April. This indicates a possible shutdown by miners of equipment whose operation has become unprofitable after halving.

Canaan has unveiled the flagship product of its new generation of Bitcoin mining devices, the Avalon A1566 series A15. The Bitcoin miner delivers a hash rate of 185 TH/s with a power consumption of 3240W.

The European Securities and Markets Authority will discuss the inclusion of crypto assets in the €12 trillion UCITS investment funds. “The impact of this move will be more significant than in the case of US ETFs, as multiple funds are interested in investing a small percentage of liquidity in crypto assets,” said DLA Piper.

The Dencun update has made the Ethereum cryptocurrency inflationary again, potentially threatening the narrative of ether as “ultra-secure” money, according to CryptoQuant. The supply of ETH has been growing at the highest daily rate since then.

Wallet developer Exodus has postponed its IPO on NYSE before it gets a review from the SEC. The firm explained the decision based on the regulator’s continued review of the securities registration application.

The FxPro Analyst Team